CAS MONOGRAPH SERIES

NUMBER 4

USING THE ODP BOOTSTRAP MODEL:

A PRACTITIONER’S GUIDE

Mark R. Shapland

CASUALTY ACTUARIAL SOCIETY

ere are many papers that describe the over-dispersed Poisson (ODP) bootstrap

model, but these papers are either limited to the basic calculations of the model or

focus on the theoretical aspects of the model and always implicitly assume that the

ODP bootstrap model is perfectly suited to the data being analyzed. In order to use

the ODP bootstrap model on real data, the analyst must rst test and review the

assumptions of the model and may need to consider various modications to the basic

algorithm in order to put the ODP bootstrap model to practical use. is monograph

starts by gathering the evolutionary changes from dierent papers into a complete ODP

bootstrap modeling framework using a standard notation. en it generalizes the basic

model into a more exible framework. Next it describes the adjustments or enhancements

required for practical use and addresses the diagnostic testing of the model assumptions.

While this monograph is focused on the ODP bootstrap model, we must recognize that

it is a special subset of a larger framework of models and that there are a wide variety of

other stochastic models that should also be considered. However, since no single model

is perfect we also explore ways to combine or credibility weight the ODP bootstrap model

results with various other models in order to arrive at a “best estimate” of the distribution,

similar to how a deterministic best estimate is generally derived in practice. Finally, the

monograph will also extend the model to illustrate the GLM Bootstrap and the model

output to address other risk management issues and suggest areas for future research.

Keywords. Bootstrap, Over-Dispersed Poisson, Reserve Variability, Reserve Range,

Distribution of Possible Outcomes, Generalized Linear Model, Best Estimate.

Availability of

Excel workbooks. In lieu of technical appendices, several

companion Excel workbooks are included that illustrate the calculations described in this

monograph. The companion materials are summarized in the Supplementary

Materials section and are available at https://www.casact.org/sites/default/

files/2021-02/practitionerssuppl-shaplandmonograph04.zip. Other sources of ODP

bootstrap modeling software that could be used for educational purposes would include

working parties and other industry groups in North America and Europe, including

but not limited to models freely available in the R statistical software package.

Casualty Actuarial Society

4350 North Fairfax Drive, Suite 250

Arlington, Virginia 22203

www.casact.org

(703) 276-3100

USING THE ODP BOOTSTRAP MODEL:

A PRACTITIONER’S GUIDE

Mark R. Shapland

Using the ODP Bootstrap Model: A Practitioner’s Guide

By Mark R. Shapland

Copyright 2016 by the Casualty Actuarial Society

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or

transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise,

without the prior written permission of the publisher. For information on obtaining permission for use of

material in this work, please submit a written request to the Casualty Actuarial Society.

Library of Congress Cataloguing-in-Publication Data

Shapland, Mark R.

Using the ODP Bootstrap Model: A Practitioner’s Guide

ISBN 978-0-9968897-4-2 (print edition)

ISBN 978-0-9968897-5-9 (electronic edition)

1. Actuarial science. 2. Loss reserving. 3. Insurance—Mathematical models.

I. Shapland, Mark

1. Introduction .................................................................................................... 1

1.1. Objectives ................................................................................................2

2. Notation ........................................................................................................... 4

3. e Bootstrap Model ....................................................................................... 6

3.1. Origins of Bootstrapping ..........................................................................7

3.2. e Over-Dispersed Poisson Model ..........................................................8

3.3. Variations on the ODP Model ................................................................14

3.4. e GLM Bootstrap Model ....................................................................16

4. Practical Issues ............................................................................................... 20

4.1. Negative Incremental Values ...................................................................20

4.2. Non-Zero Sum of Residuals ...................................................................23

4.3. Using an N-Year Weighted Average ........................................................23

4.4. Missing Values ........................................................................................24

4.5. Outliers ..................................................................................................24

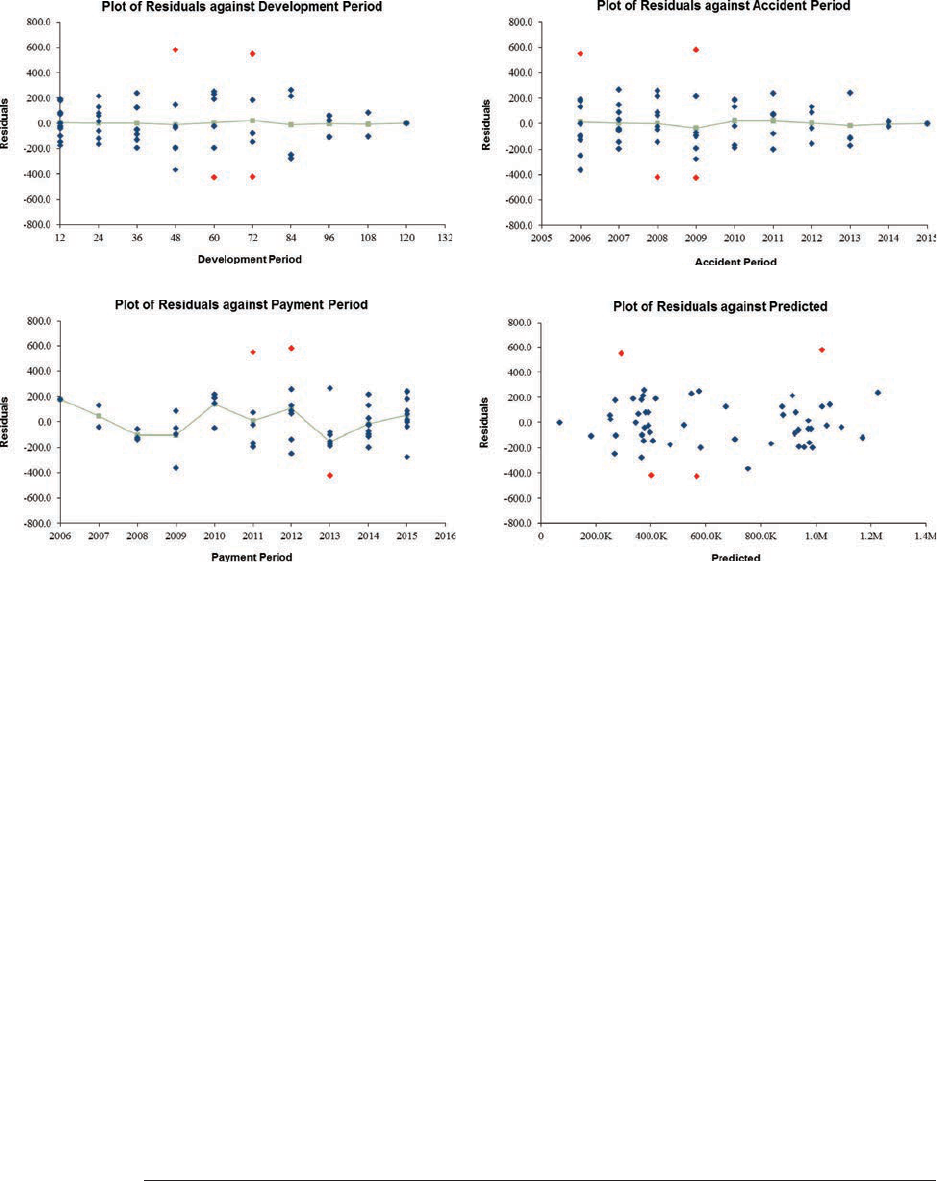

4.6. Heteroscedasticity ..................................................................................25

4.7. Heteroecthesious Data............................................................................27

4.8. Exposure Adjustment .............................................................................29

4.9. Tail Factors .............................................................................................29

4.10. Fitting a Distribution to ODP Bootstrap Residuals ................................30

5. Diagnostics .................................................................................................... 31

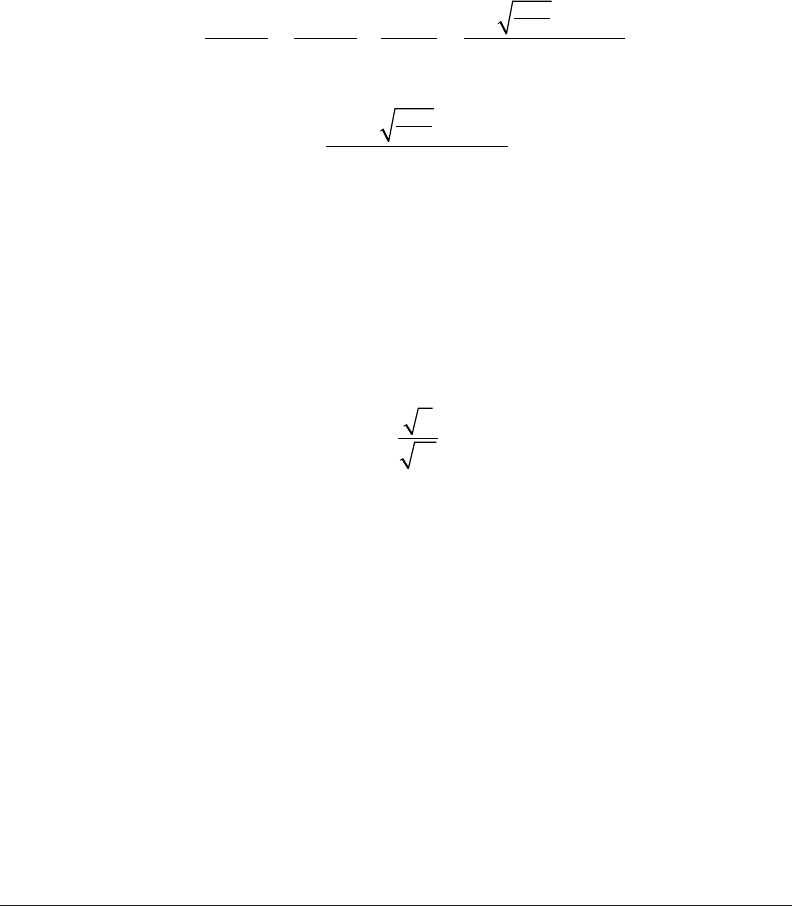

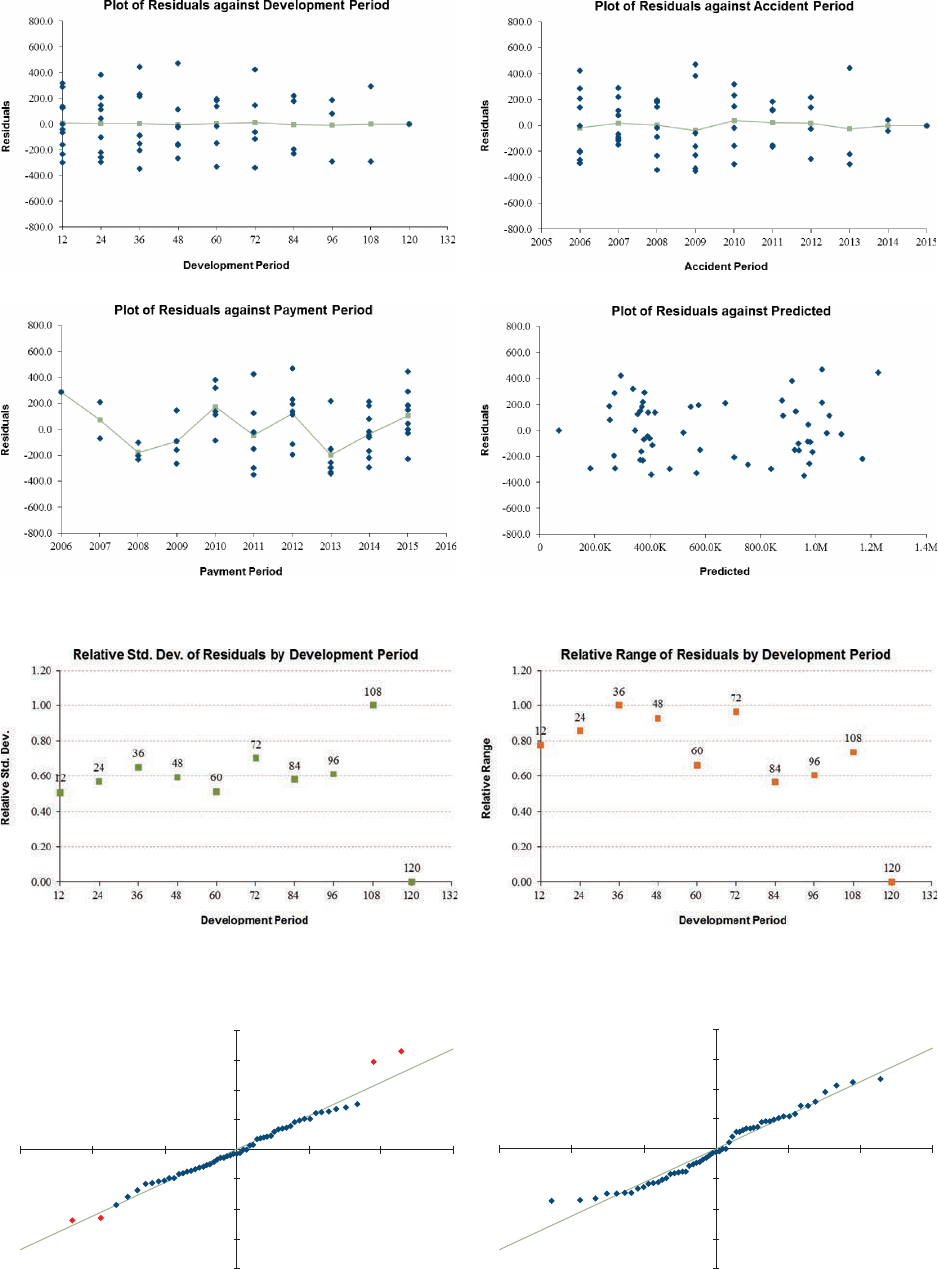

5.1. Residual Graphs .....................................................................................32

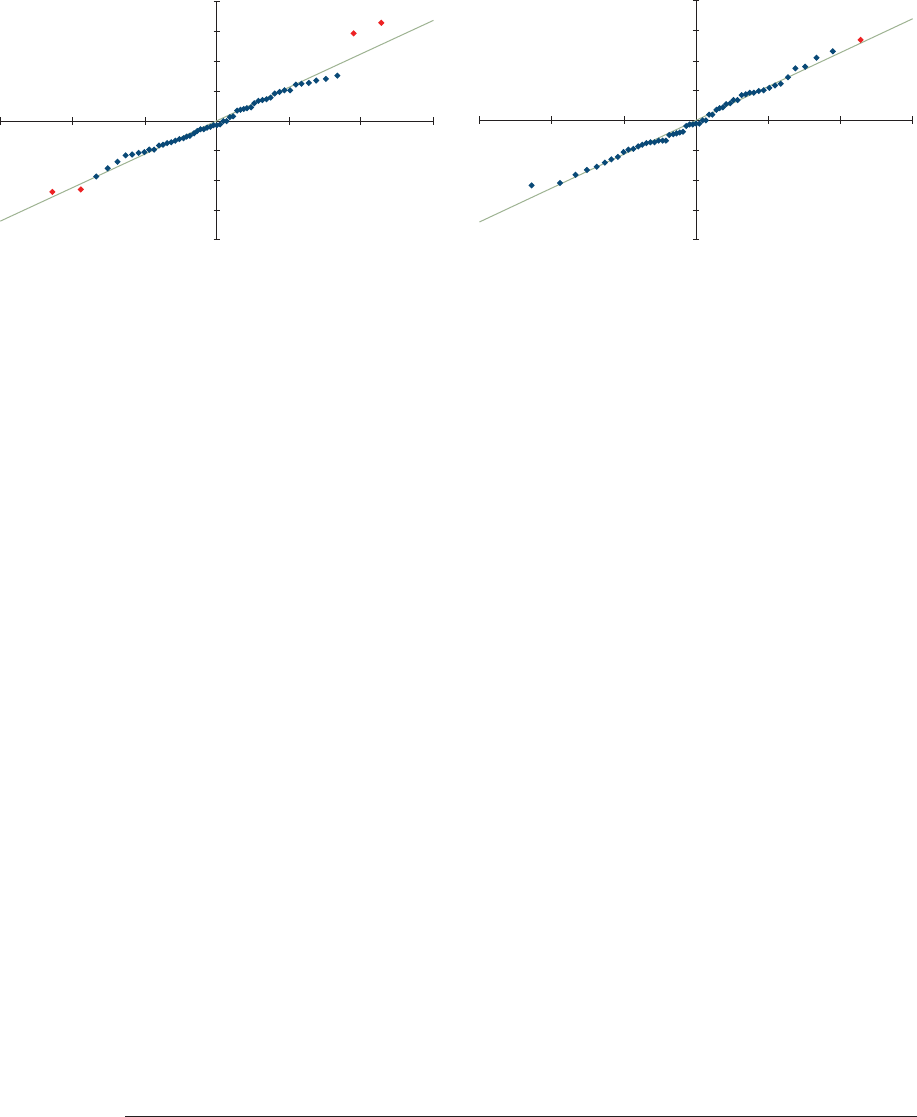

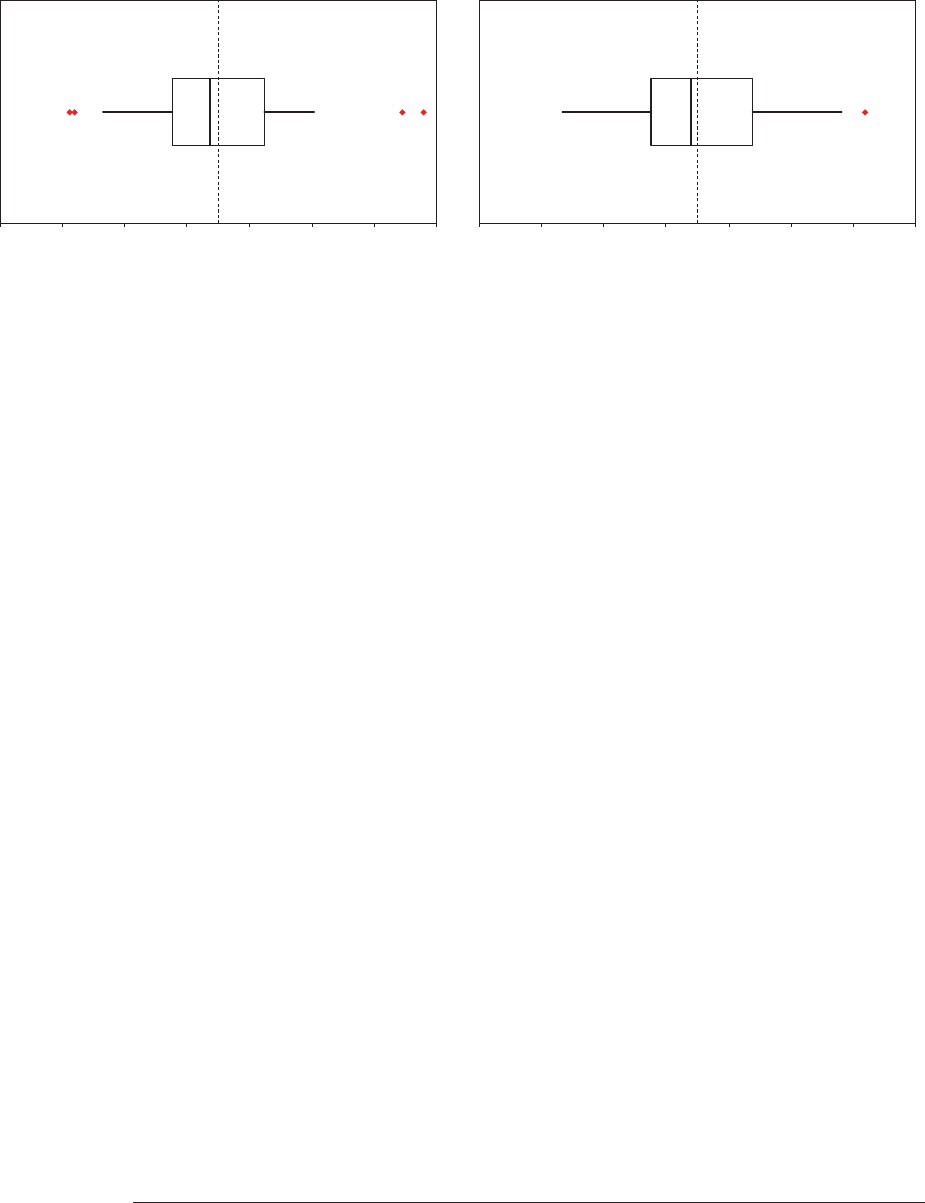

5.2. Normality Test .......................................................................................33

5.3. Outliers ..................................................................................................36

5.4. Parameter Adjustment ............................................................................37

5.5. Model Results ........................................................................................41

6. Using Multiple Models .................................................................................. 45

6.1. Additional Useful Output ......................................................................49

6.2. Estimated Cash Flow Results ..................................................................49

6.3. Estimated Ultimate Loss Ratio Results ...................................................50

6.4. Estimated Unpaid Claim Runoff Results ................................................51

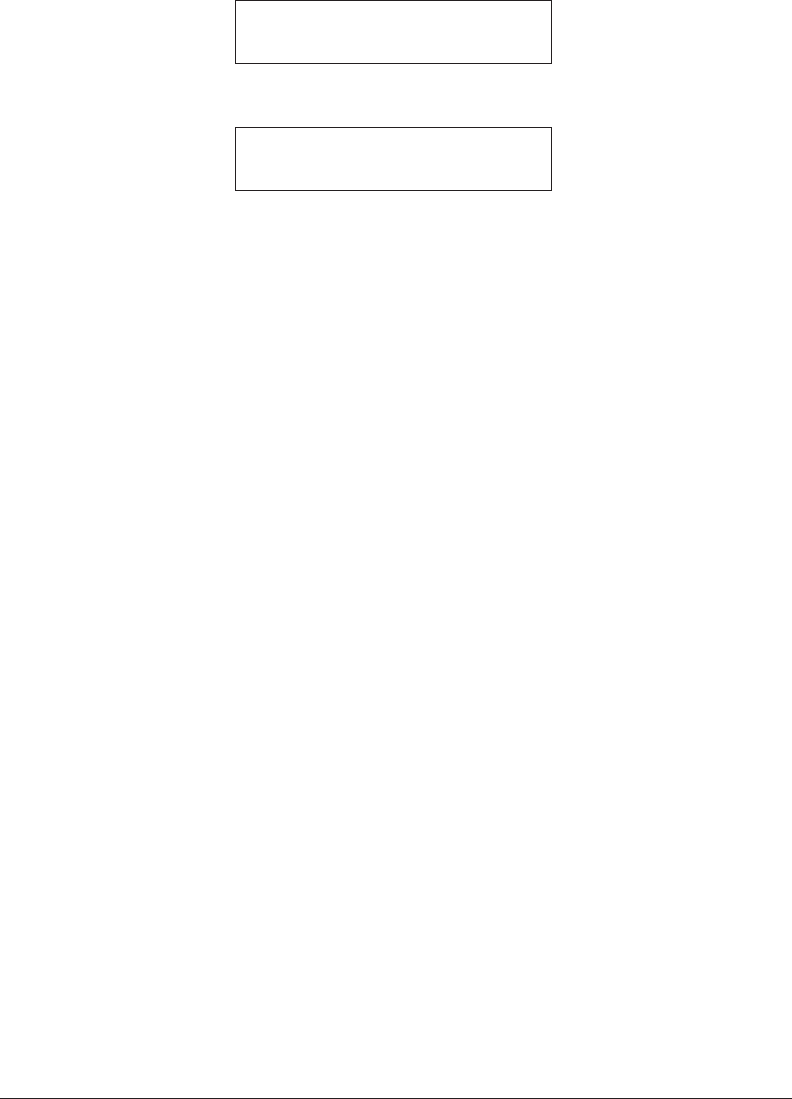

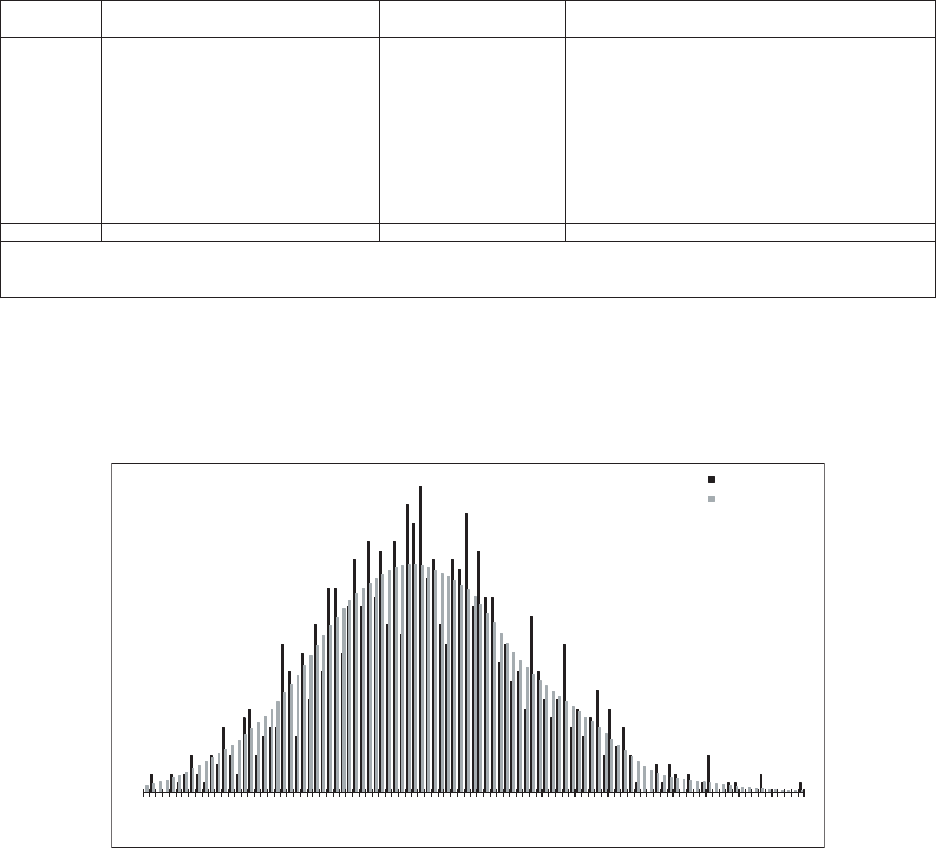

6.5. Distribution Graphs ...............................................................................51

6.6. Correlation .............................................................................................53

Contents

iv Casualty Actuarial Society

Contents

7. Model Testing ................................................................................................ 56

7.1. Bootstrap Model Results ........................................................................56

7.2. Future Testing ........................................................................................57

8. Future Research ............................................................................................. 58

9. Conclusions ................................................................................................... 59

APPENDICES ...................................................................................................... 63

Appendix A—Schedule P, Part A Results ..........................................................65

Appendix B—Schedule P, Part B Results ..........................................................78

Appendix C—Schedule P, Part C Results .........................................................91

Appendix D—Aggregate Results ....................................................................104

Appendix E—GLM Bootstrap Results ...........................................................108

References ........................................................................................................... 111

Selected Bibliography ......................................................................................... 114

Abbreviations and Notations .............................................................................. 115

About the Author ................................................................................................ 116

e concept of bootstrapping generally invokes the idea that once a process has been

started, it can replicate without additional external input. Disciplines from biology and

physics to business and statistics use bootstrapping to analyze numerous processes. For

example, in statistics, bootstrapping involves starting with one sample and using it to

derive many more subsamples drawn from the original sample. A specialized applica-

tion within actuarial science involves derivation of a distribution of possible outcomes

for each step in the loss development process.

Considerable literature has been developed over the past twenty-plus years regarding

bootstrapping as it relates to actuarial science and the loss reserving process. In this work,

Mr. Shapland collects the research from this vast literature base and frames it in one

comprehensive presentation. e result is a complete over-dispersed Poisson (ODP)

bootstrap model. At the same time, those who have worked with ODP bootstrapping

know that these models have limitations when using real-world data. Mr. Shapland’s work

also proposes modifications and enhancements that allow more practical application of

the ODP bootstrap model. In addition, he provides details on generalized linear models,

of which the ODP bootstrap is one form.

With the knowledge that model risk is a real risk—no single model is perfect—

Mr. Shapland further explores ways to combine the results of ODP bootstrapping with

other types of models in an effort to determine a true “best estimate” of the distribution.

A set of illustrative Excel files, along with detailed instructions on how to use them,

complements this monograph. With these files, the reader can follow through, step by

step, the theory presented in monograph.

is monograph provides a one-stop shop for practical application of bootstrapping

for the loss reserving process. e Monographs Editorial Board thanks the author for a

valuable contribution to the casualty actuarial literature.

Leslie R. Marlo

Chairperson

Monograph Editorial Board

Foreword

Leslie R. Marlo, Editor in Chief

Emmanuel Bardis

Brendan P. Barrett

Craig C. Davis

Ali Ishaq

C. K. Stan Khury, consultant

Glenn G. Meyers, consultant

Katya Ellen Press, consultant

2016 CAS Monograph Editorial Board

Casualty Actuarial Society 1

e term “bootstrap” has a colorful history that dates back to German folk tales of

the 18th century. It is aptly conveyed in the familiar cliché admonishing laggards to

“pull oneself up by their own bootstraps.” A physical paradox and virtual impossibility,

the idea has nonetheless caught the imagination of scientists in a broad array of elds,

including physics, biology and medical research, computer science, and statistics.

Bradley Efron (1979), Chairman of the Department of Statistics at Stanford Uni-

versity, is most often associated as the source of expanding bootstrapping into the realm

of statistics, with his notion of taking one available sample and using it to arrive at many

others through resampling.

In actuarial science, the concept of bootstrapping has become increasingly common

in the process of loss reserving. e most commonly cited examples are England and

Verrall (1999; 2002), Pinheiro, et al. (2003), and Kirschner, et al. (2008), who combine

the bootstrap concept with a basic chain ladder model. ese papers detail a form of

the model where the incremental losses are modeled as over-dispersed Poisson random

variables. In this monograph, it is called the over-dispersed Poisson bootstrap model, or

the ODP bootstrap. e goal of the ODP bootstrap model is to generate a distribution

of possible outcomes, rather than a point estimate, providing more information about

the potential results.

At the present time, the vast majority of reserving actuaries in the U.S. are focused on

deterministic point estimates. is is not surprising as the American Academy of Actuaries’

primary standard of practice for reserving, ASOP 36, is focused on deterministic

point estimates and the actuarial opinion required by regulators is also focused on

deterministic estimates. However, actuaries are moving towards estimating an unpaid

claim distribution, encouraged by the following factors:

• ASOP 43 denes “actuarial central estimate” in such a way that it could include

either deterministic point estimates or a rst moment estimate from a distribution;

• the SEC is looking for more reserving risk information in the 10-K reports led by

publicly traded companies;

• all of the major rating agencies have built or are building dynamic risk models to

help with their insurance rating process and welcome the input of company actuaries

regarding unpaid claim distributions;

• companies that use dynamic risk models to help their internal risk management

processes need unpaid claim distributions;

1. Introduction

2 Casualty Actuarial Society

Using the ODP Bootstrap Model: A Practitioner’s Guide

• e Solvency II regime in Europe is moving many insurers towards unpaid claim

distributions; and

• International Financial Accounting Standards, while still being discussed, shows

actuaries that the future of insurance accounting may rely on unpaid claim

distributions for booked reserves.

1.1. Objectives

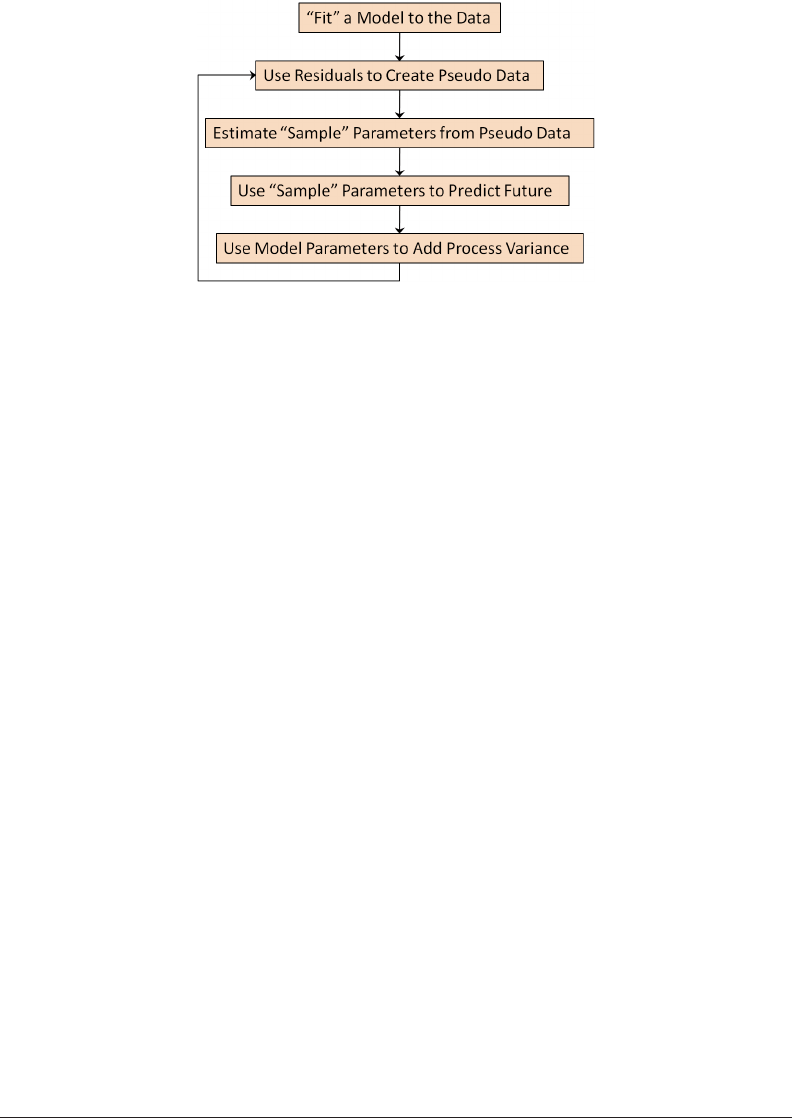

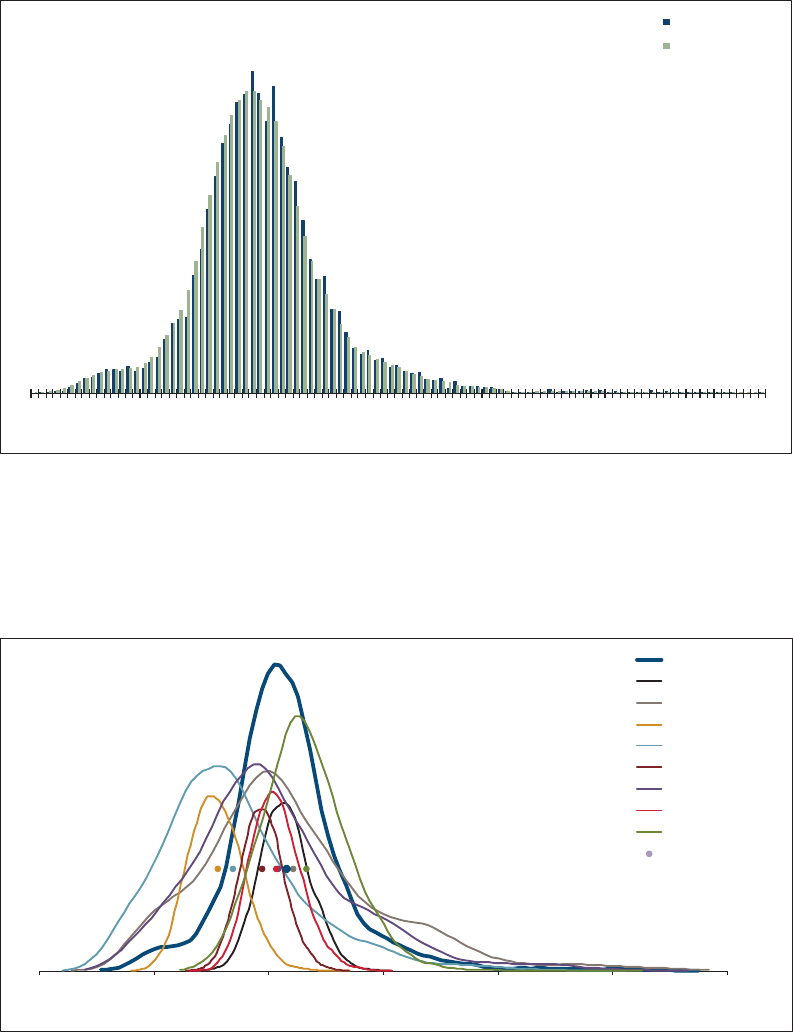

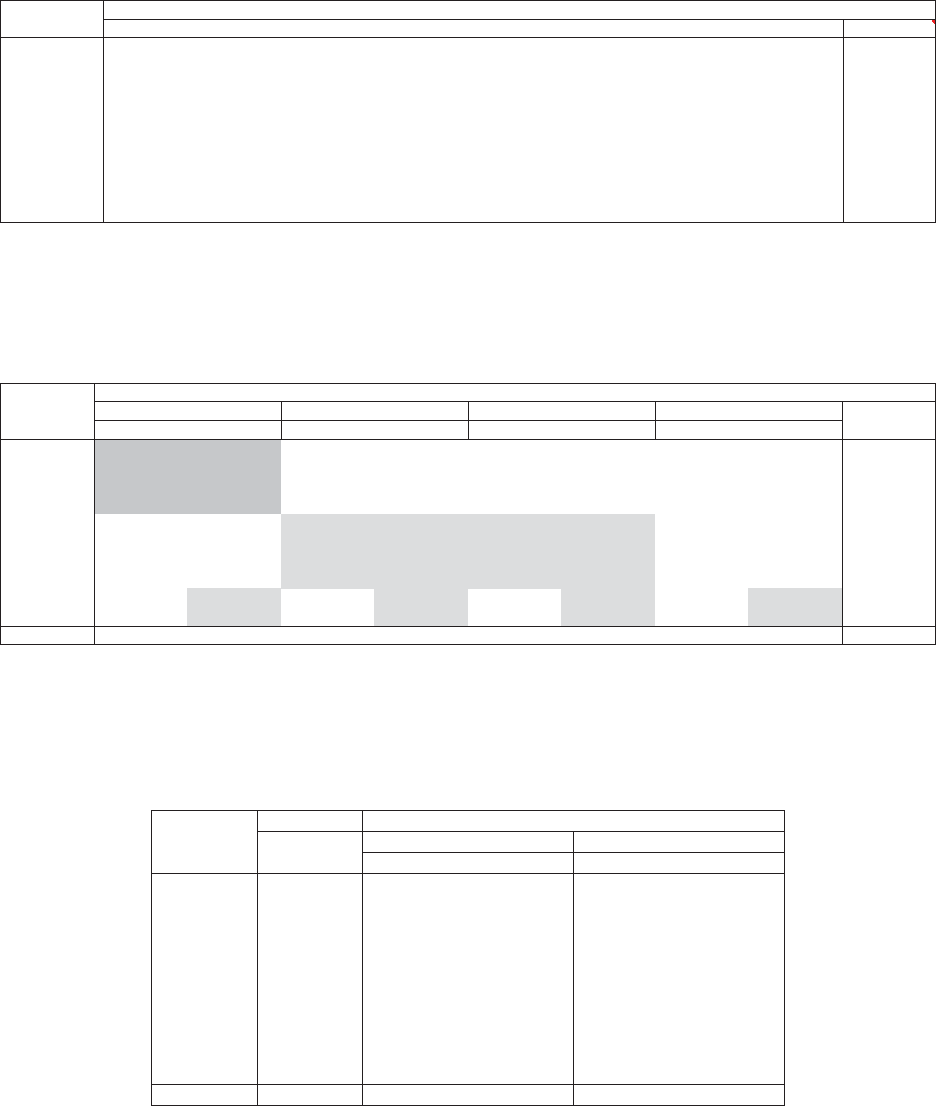

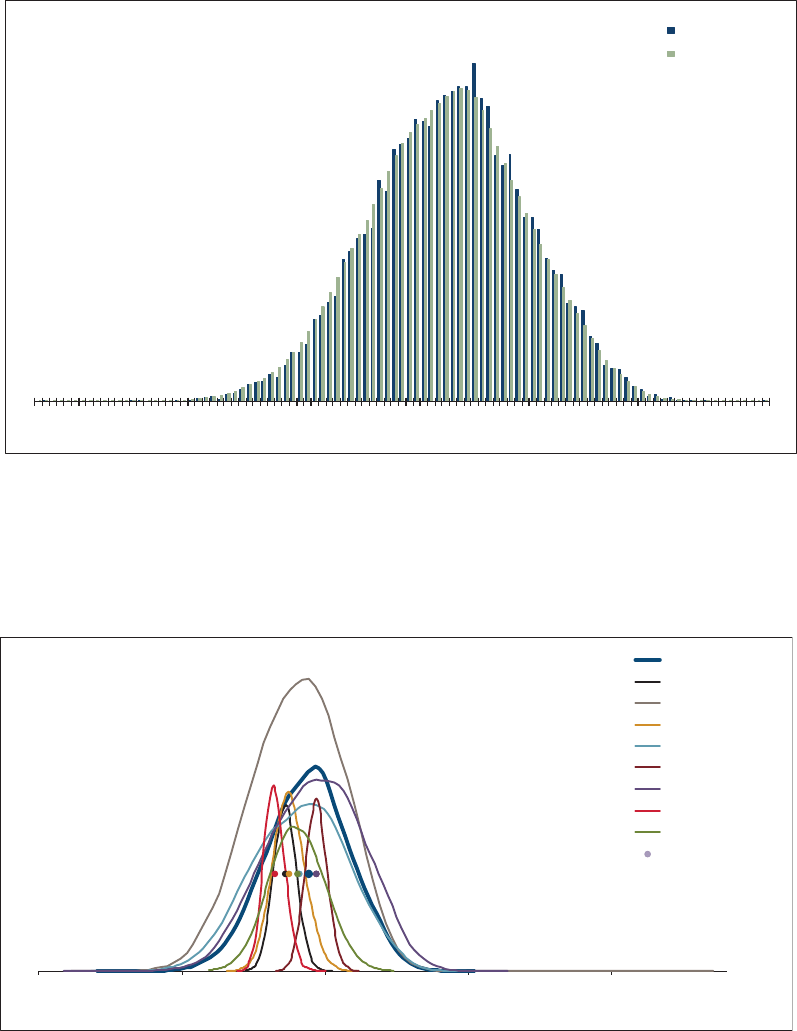

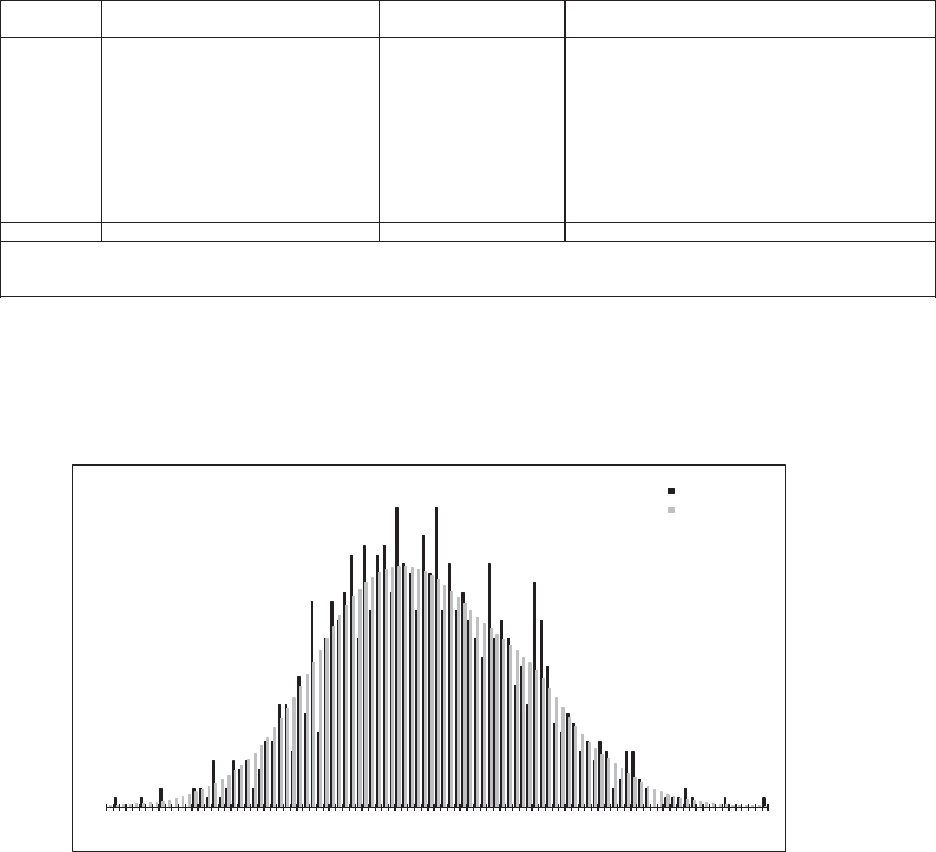

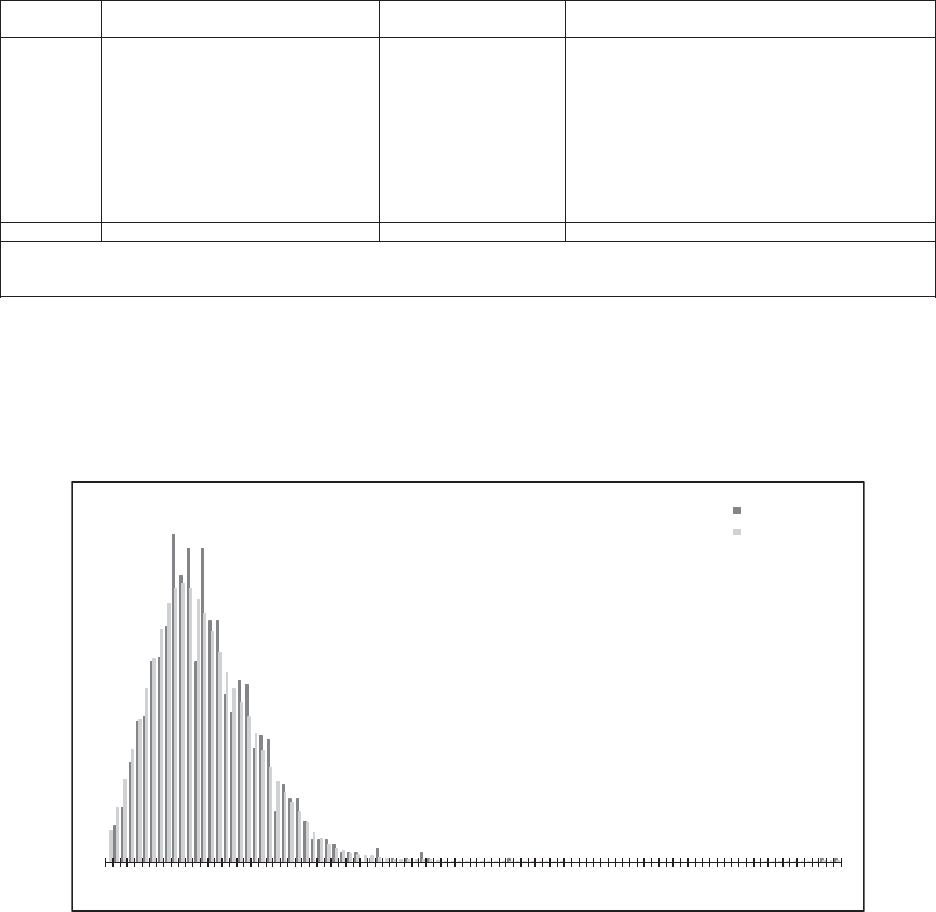

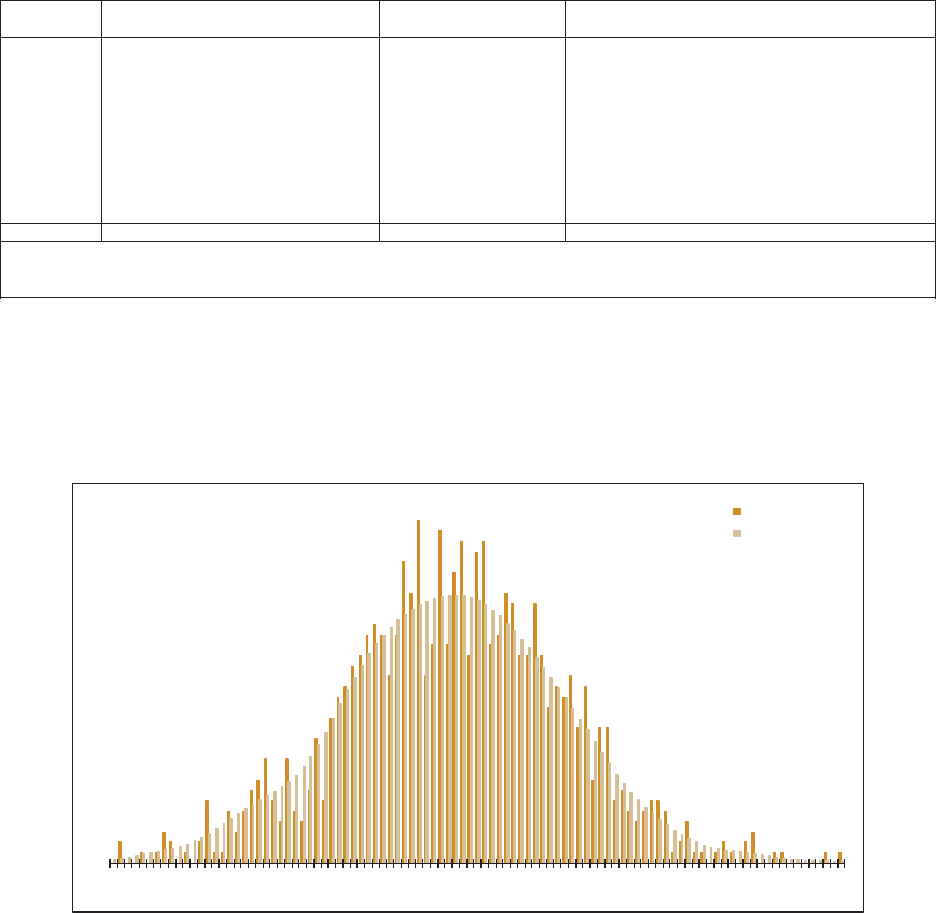

One objective of this monograph is to provide more practical details on the Generalized

Linear Model (GLM), of which the ODP bootstrap model

1

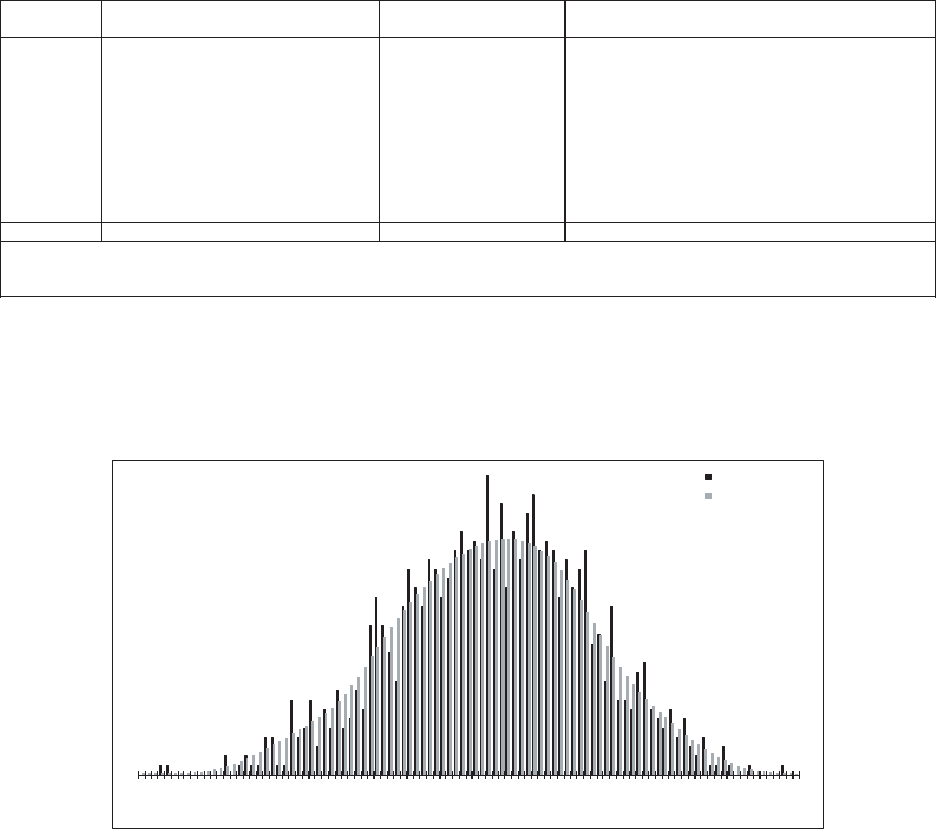

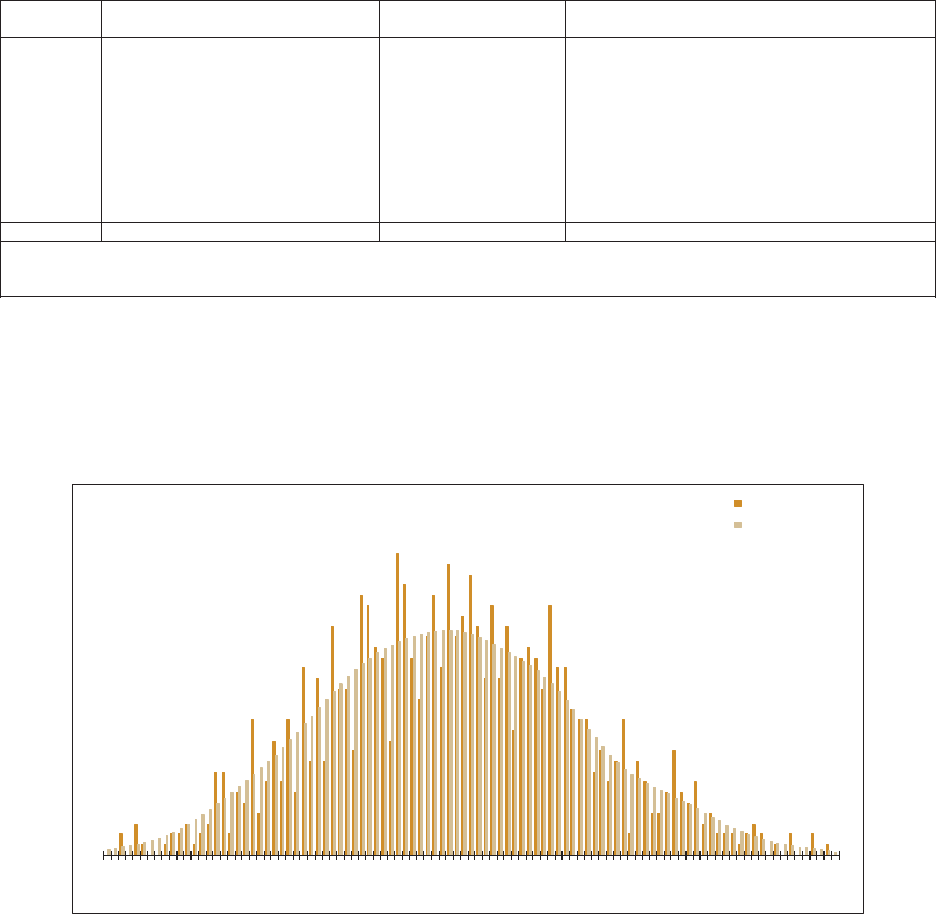

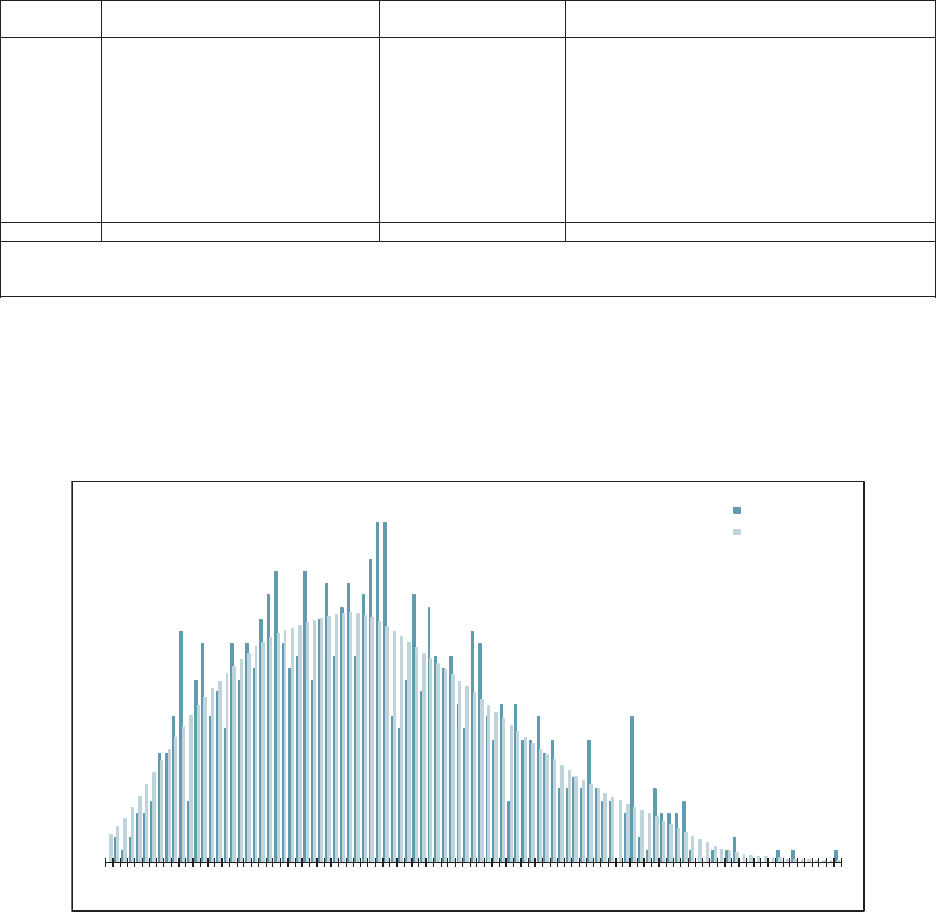

is a specic form. A GLM

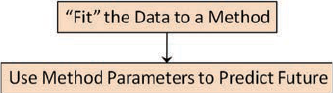

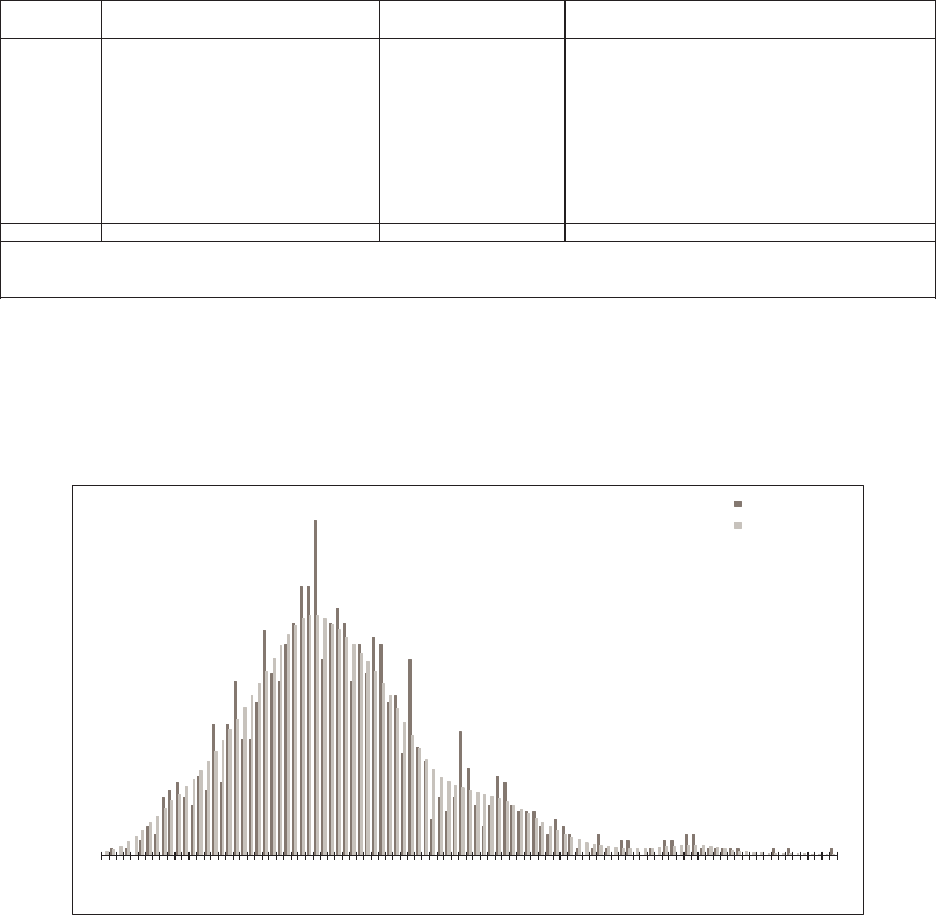

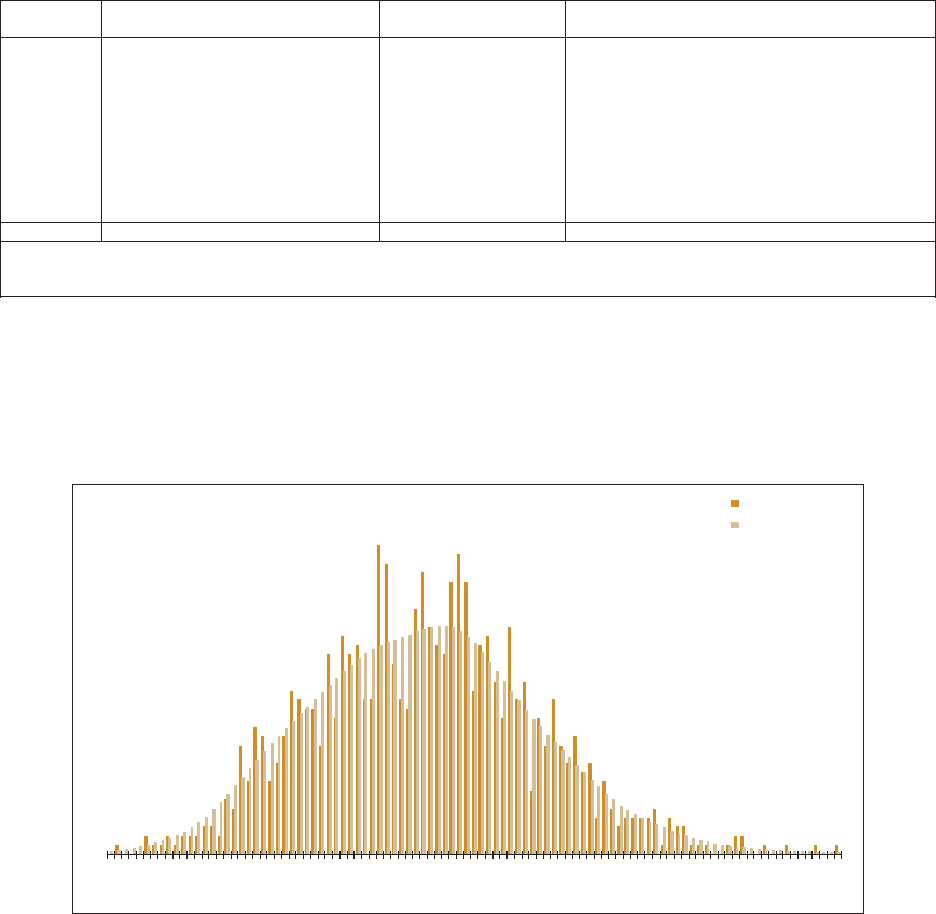

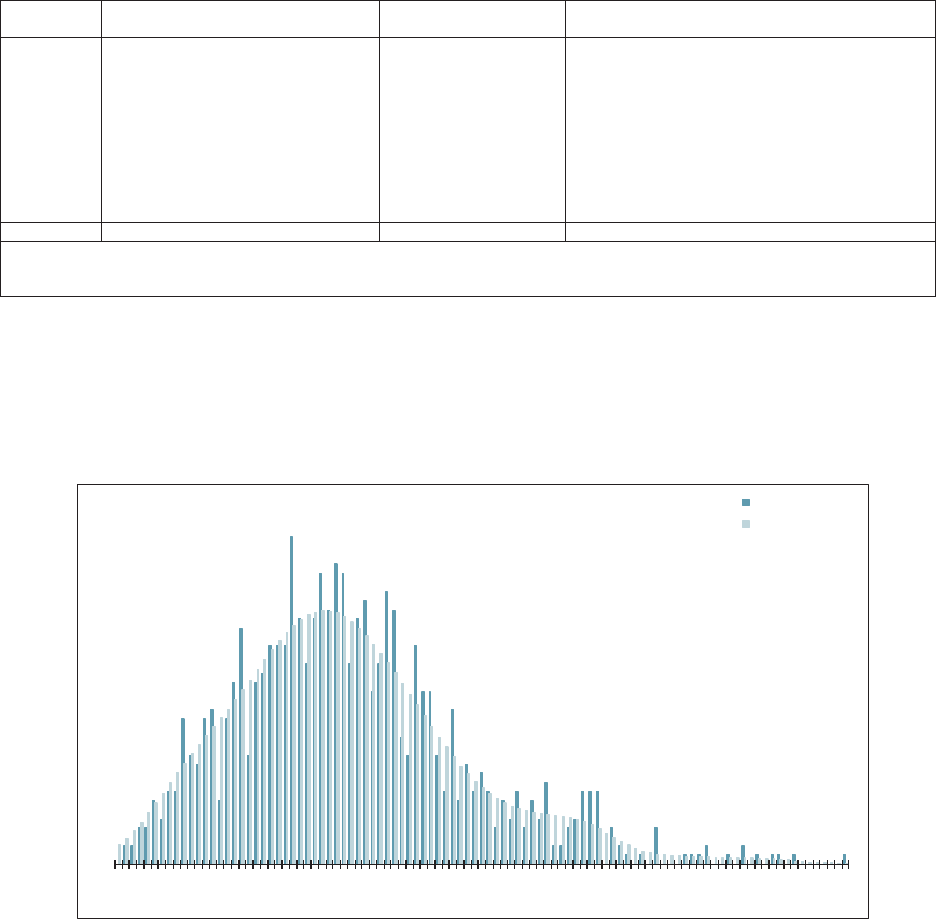

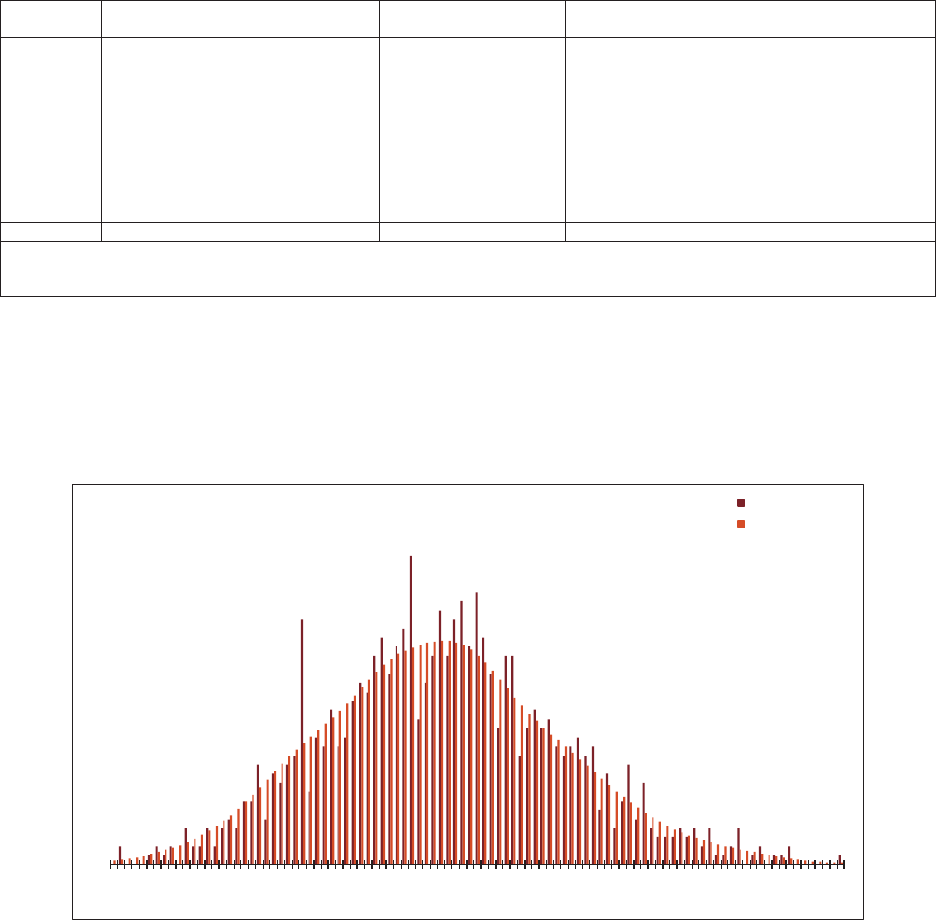

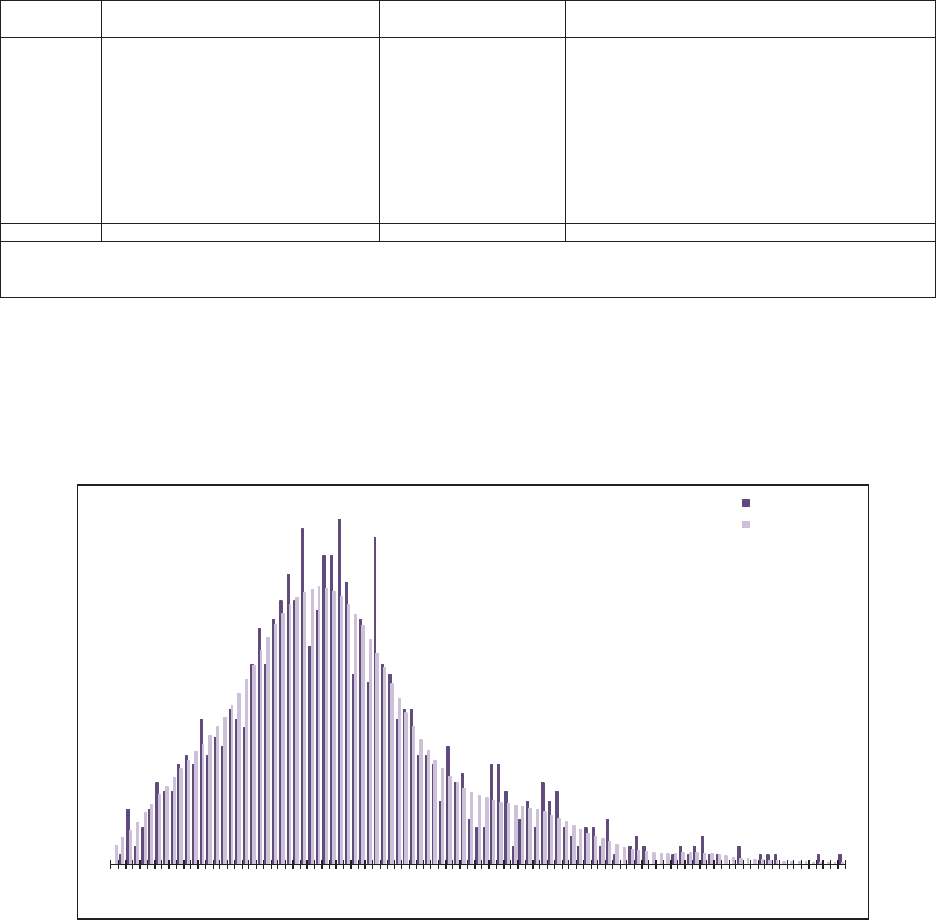

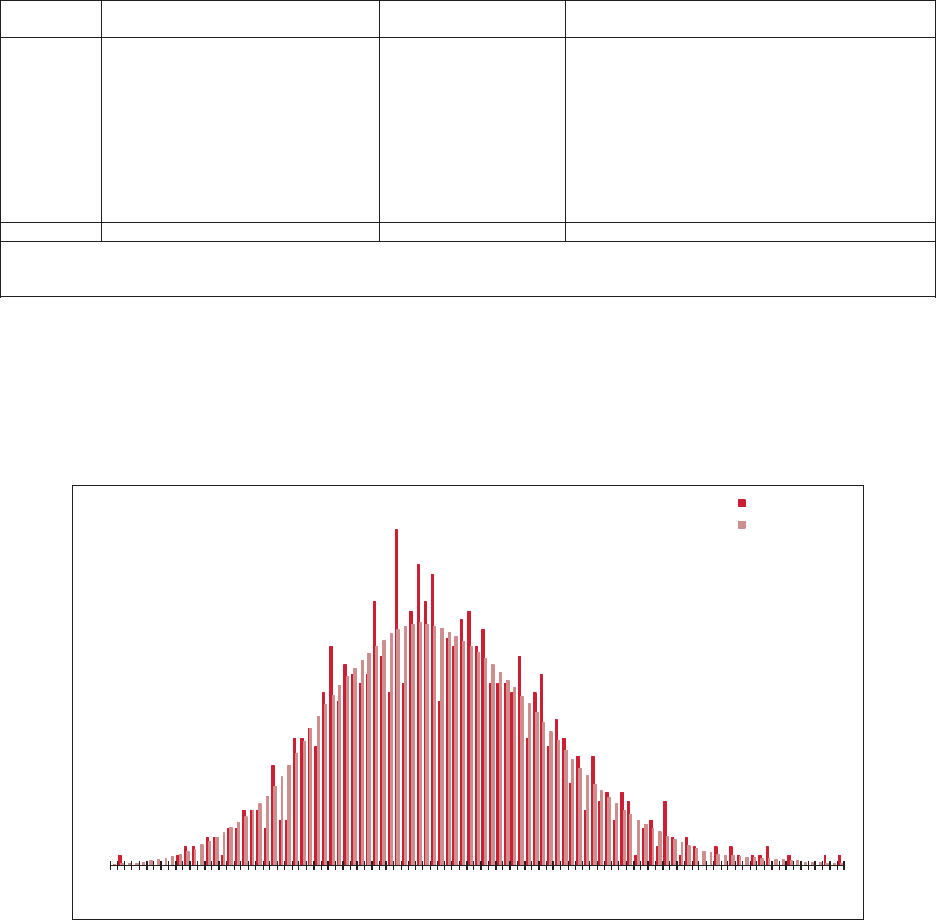

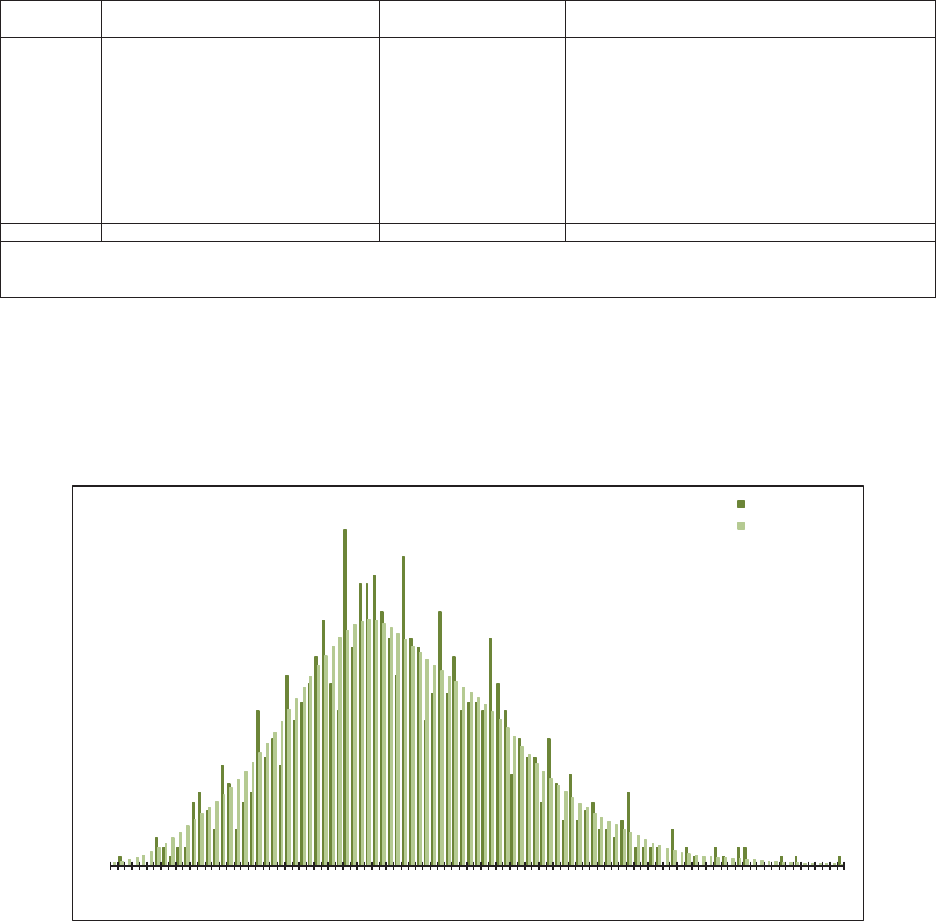

allows the user to “t” the model to the data, as illustrated in Figure 1.1. e benet

of a GLM is that it can be specically tailored to the statistical features found in the

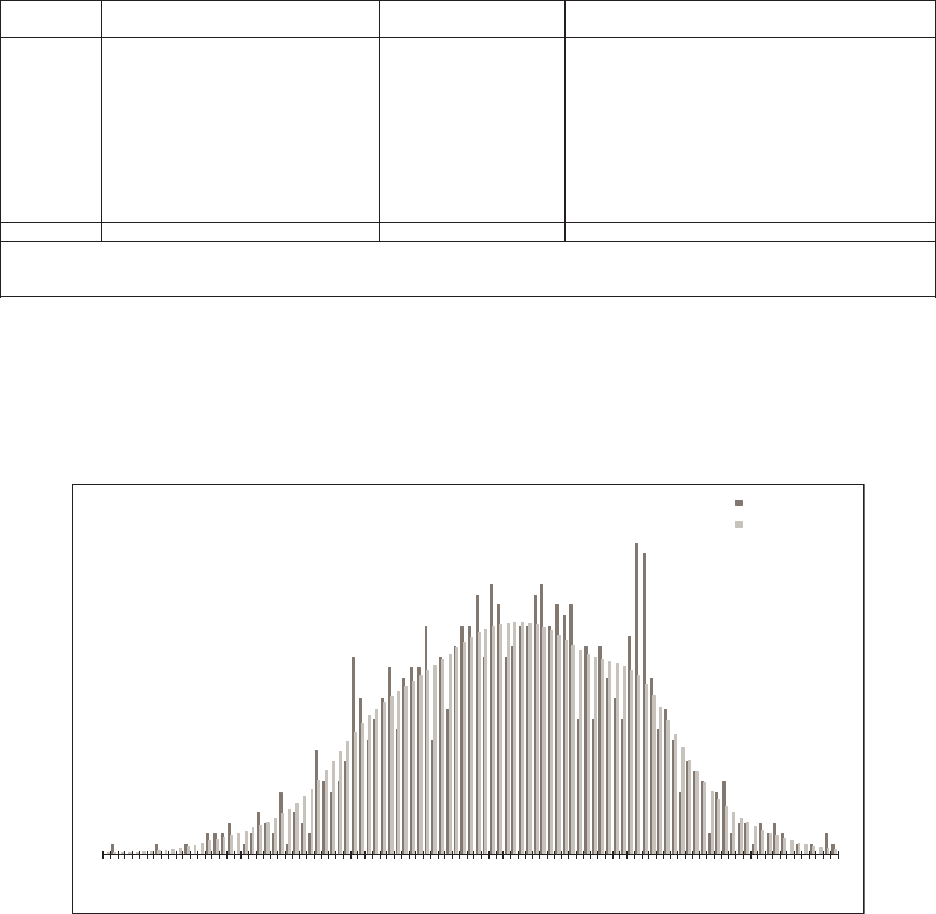

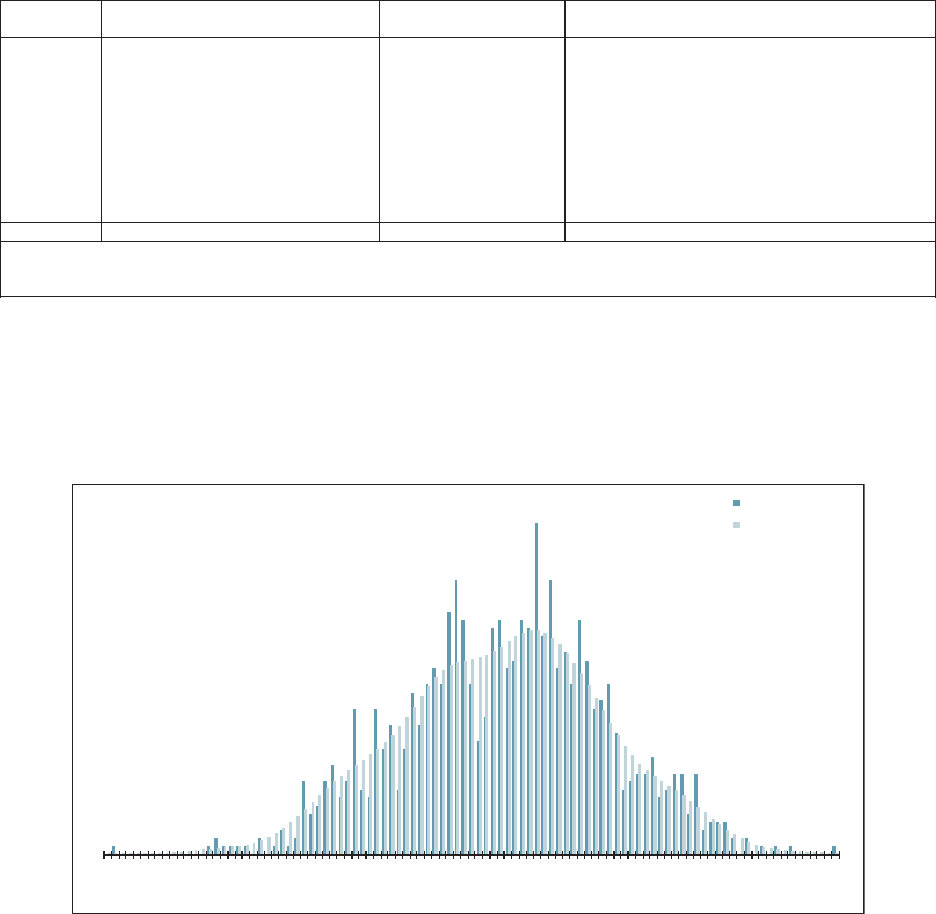

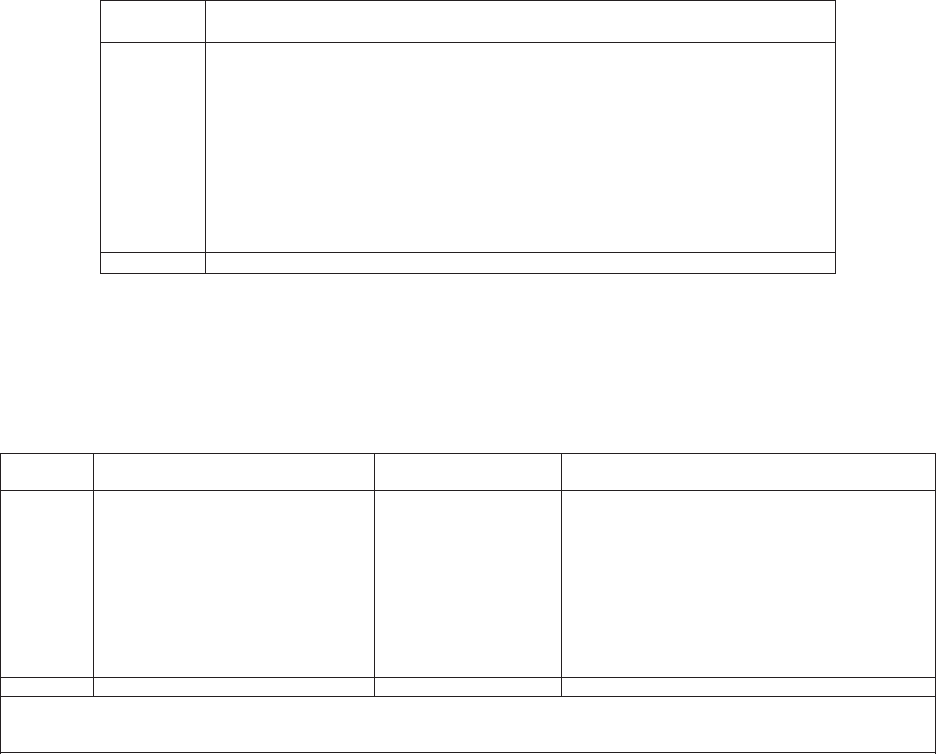

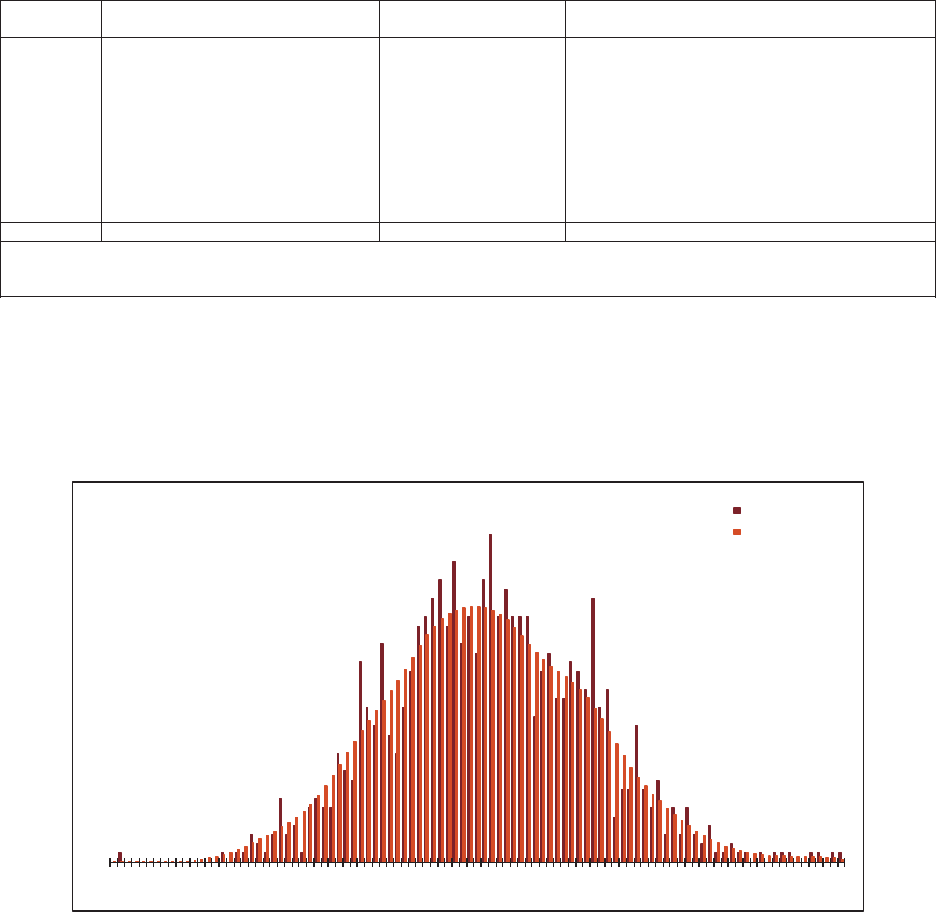

data under analysis. In contrast, consider algorithms that essentially force the data to

be “t” to a static method in order to predict the future as illustrated in Figure 1.2.

2

If a method does not use parameters or assumptions that t the statistical features

of the data then it may not project a reasonable point estimate. Similarly, if model

assumptions and parameters do not t the statistical features found in the data then the

results of a simulation may not be a very good estimate of the distribution of possible

outcomes. us, the modeling framework must be able to adapt to or “t” the model

to the data so this point will be elaborated on in later sections.

Another objective of this monograph is to show how the ODP bootstrap modeling

framework can be used in practice, to help the wider adoption of unpaid claim distribu-

tions. Most of the papers describing stochastic models, including the ODP bootstrap

model, tend to focus primarily on the theoretical aspects of the model while ignoring

the data issues that commonly arise in practice. As a result the models can be quite

elegantly implemented yet suer from practical limitations such as only being useful

1

Some authors dene a model as having a dened structure and error distribution, so under this more restrictive

denition bootstrapping would be considered to be a method or algorithm. However, using a less restrictive

denition of a model as an algorithm that produces a distribution, bootstrapping would be dened as a model.

2

For most deterministic reserving methods diagnostic tools can be used to test assumptions, adjust parameters and

“t” the method to the data, but not all assumptions can be adjusted and blindly applying a method is equivalent

to a static method.

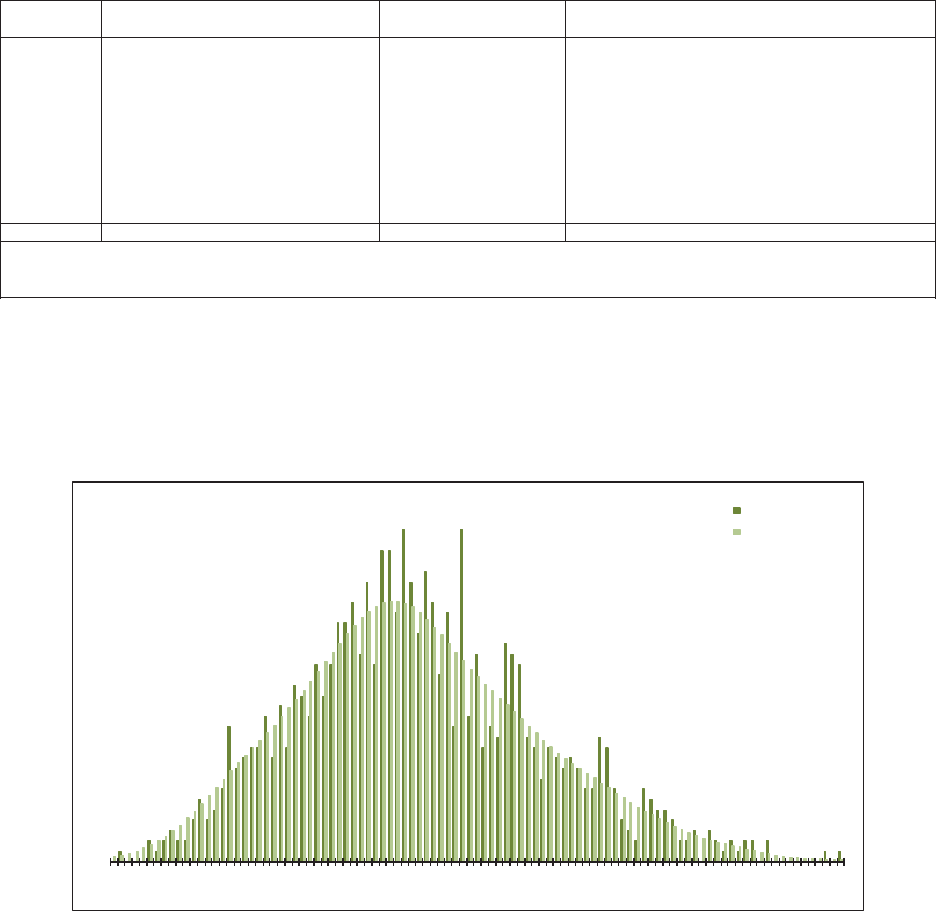

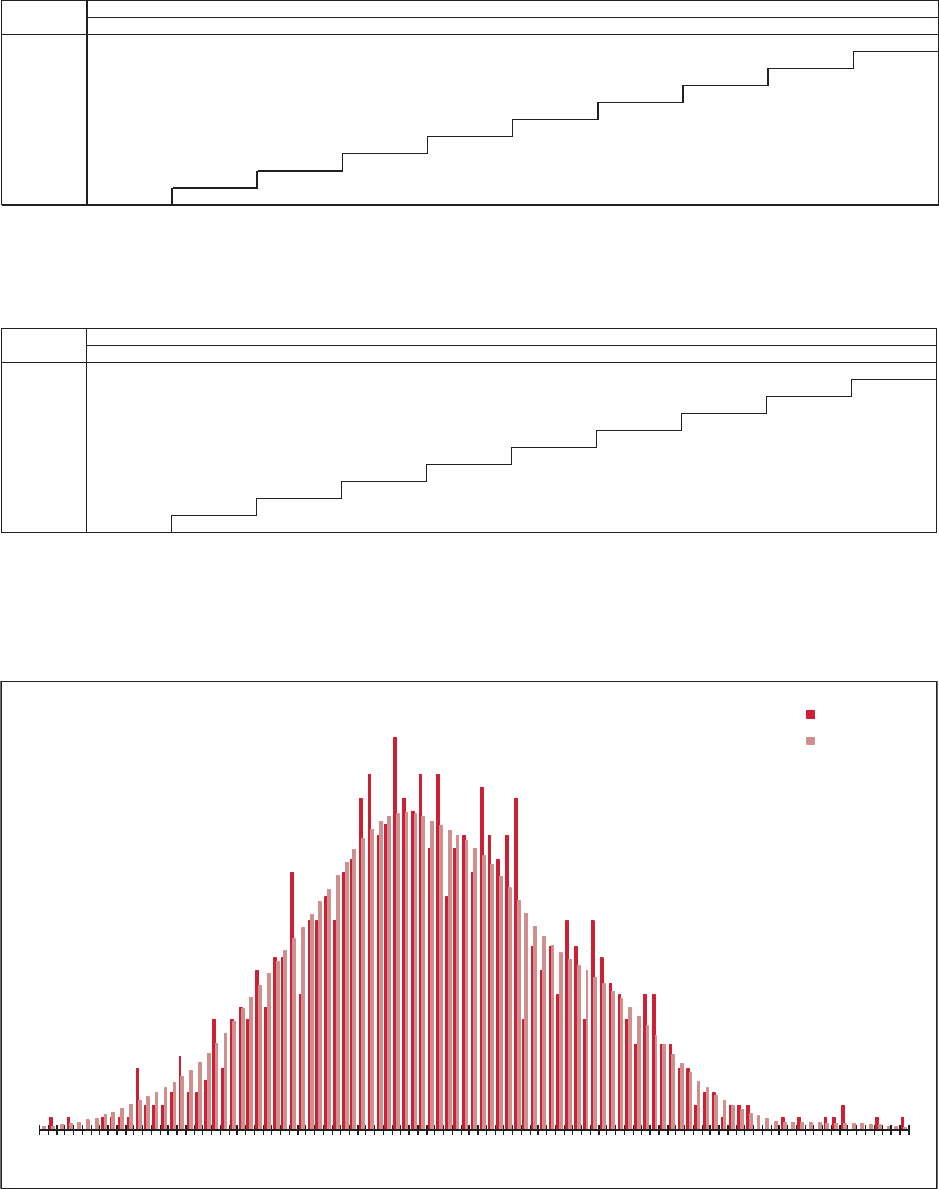

Figure 1.1. Stochastic Model Diagram

Casualty Actuarial Society 3

Using the ODP Bootstrap Model: A Practitioner’s Guide

for complete triangles or only for positive incremental values. us, while keeping as

close to the theoretical foundation as possible, another objective is to illustrate how

practical adjustments can be made to accommodate common data issues and allow the

model to “t” the data. As a practical matter, it is also possible that the model does not

t the data very well, or less well than other models, so the process of diagnosing the

assumptions will inform the actuary’s judgment when considering how much weight,

if any, to give the model in relation to other models.

Another potential roadblock seems to be the notion that actuaries are still searching

for the perfect model to describe “the” distribution of unpaid claims, as if imperfections

in a model remove it from all consideration since it can’t be “the one.” is notion can

also manifest itself when an actuary settles for a model that seems to work the best or is

the easiest to use, or with the idea that each model must be used in its entirety or not at

all. Interestingly, this notion was dispelled long ago with respect to deterministic point

estimates as actuaries commonly use many dierent methods, which range from easy to

complex, and judgmentally weight the results to arrive at their best estimate.

Model risk—the risk that the model you have chosen is not the same as the one that

generates future losses—is very real and weighting or combining multiple estimates is a

very practical way of addressing model risk. us, another objective of this monograph

is to show how stochastic reserving can be similar to deterministic reserving when it

comes to analyzing and using the best parts of multiple models by illustrating how the

results from an ODP bootstrap model can be weighted together with other models.

More importantly, the monograph hopes to illustrate the advantage of using a more

complete set of risk estimation tools (which can include both stochastic models and

deterministic methods) to arrive at an actuarial best estimate of the distribution of

possible outcomes, rather than to focus on deterministic methods to select the “mean”

and then simply “add on” a simple approximation or use only a favorite model to

turn that selected mean into a distribution.

Figure 1.2. Static Method Diagram

4 Casualty Actuarial Society

2. Notation

e papers that describe the basic ODP bootstrap model use dierent notation,

despite sharing common steps. Rather than pick the notation in one of the papers, the

notation from the CAS Working Party on Quantifying Variability in Reserve Estimates

Summary Report (CAS Working Party 2005) will be used since it is intended to serve

as a basis for further research.

Many models visualize loss data as a two-dimensional array, (w, d ) with accident

period or policy period w, and development age d (think w = “when” and d = “delay”).

For this discussion, we assume that the loss information available is an “upper triangular”

subset for rows w = 1, 2, . . . , n and for development ages d = 1, 2, . . . , n - w + 1. e

“diagonal” for which w + d equals the constant, k, represents the loss information for

each accident period w as of accounting period k.

3

For purposes of including tail factors, the development beyond the observed data

for periods d = n + 1, n + 2, . . . , u, where u is the ultimate time period for which any

claim activity occurs—i.e., u is the period in which all claims are nal and paid in full,

must also be considered.

e monograph uses the following notation for certain important loss statistics:

c(w, d ): cumulative loss from accident

4

year w as of age d.

q(w, d ): incremental loss for accident year w from d - 1 to d.

c(w, n) = U(w): total loss from accident year w when claims are at ultimate values at

time n,

5

or

c(w, u) = U(w): total loss from accident year w when claims are at ultimate values at

time u.

R(w): future development after age d for accident year w, i.e., = U(w) -

c(w, d ).

f (d ): factor applied to c(w, d ) to estimate q(w, d + 1) or can be used more

generally to indicate any factor relating to age d.

3

For a more complete explanation of this two-dimensional view of the loss information, see the Foundations of

Casualty Actuarial Science (2001), Chapter 5, particularly pages 210–226.

4

e use of accident year is used for ease of discussion. All of the discussion and formulas that follow could also

apply to underwriting year, policy year, report year, etc. Similarly, year could also be half-year, quarter or month.

5

is would imply that claims reach their ultimate value without any tail factor. is is generalized by changing n

to n + t = u, where t is the number of periods in the tail.

Casualty Actuarial Society 5

Using the ODP Bootstrap Model: A Practitioner’s Guide

F(d ): factor applied to c(w, d ) to estimate c(w, d + 1) or c(w, n) or can be

used more generally to indicate any cumulative factor relating to age d.

G(w): factor relating to accident year w—capitalized to designate ultimate

loss level.

h(k): factor relating to the diagonal k along which w + d is constant.

6

e(w, d ): a random uctuation, or error, which occurs at the w, d cell.

E(x): the expectation of the random variable x.

Var (x): the variance of the random variable x.

x*: a randomly sampled value of the variable x.

What are called factors here could also be summands, but if factors and summands

are both used, some other notation for the additive terms would be needed. e

notation does not distinguish paid vs. incurred, but if this is necessary, capitalized

subscripts P and I could be used.

6

Some authors dene d = 0, 1, . . . , n - 1 which intuitively allows k = w along the diagonals, but in this case the

triangle size is n × n - 1 which is not intuitive. With d = 1, 2, . . . , n dened as in this monograph, the triangle size

n × n is intuitive, but then k = w + 1 along the diagonals is not as intuitive. A way to think about this which helps

tie everything together is to assume the w variables are the beginning of the accident periods and the d variables

are at the end of the development periods. us, if we are using years then cell c(n, 1) represents accident year n

evaluated at 12/31/n, or essentially 1/1/n + 1.

6 Casualty Actuarial Society

3. The Bootstrap Model

Although many variations of a bootstrap model framework are possible, this monograph

will focus on the most common example which reproduces the basic chain ladder

method—the ODP bootstrap model. Let’s briey review the assumptions of the basic

chain ladder method, because these assumptions are important in understanding the

distribution created by the ODP bootstrap model.

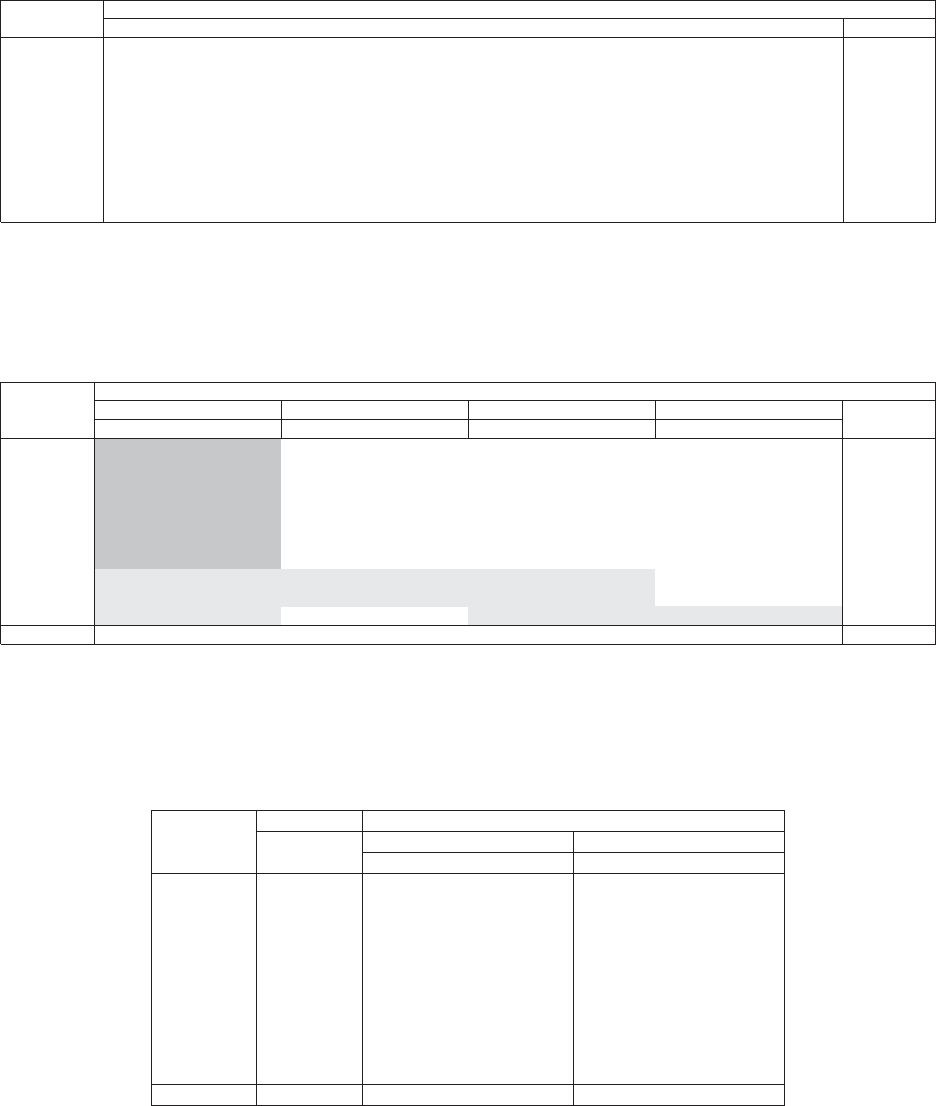

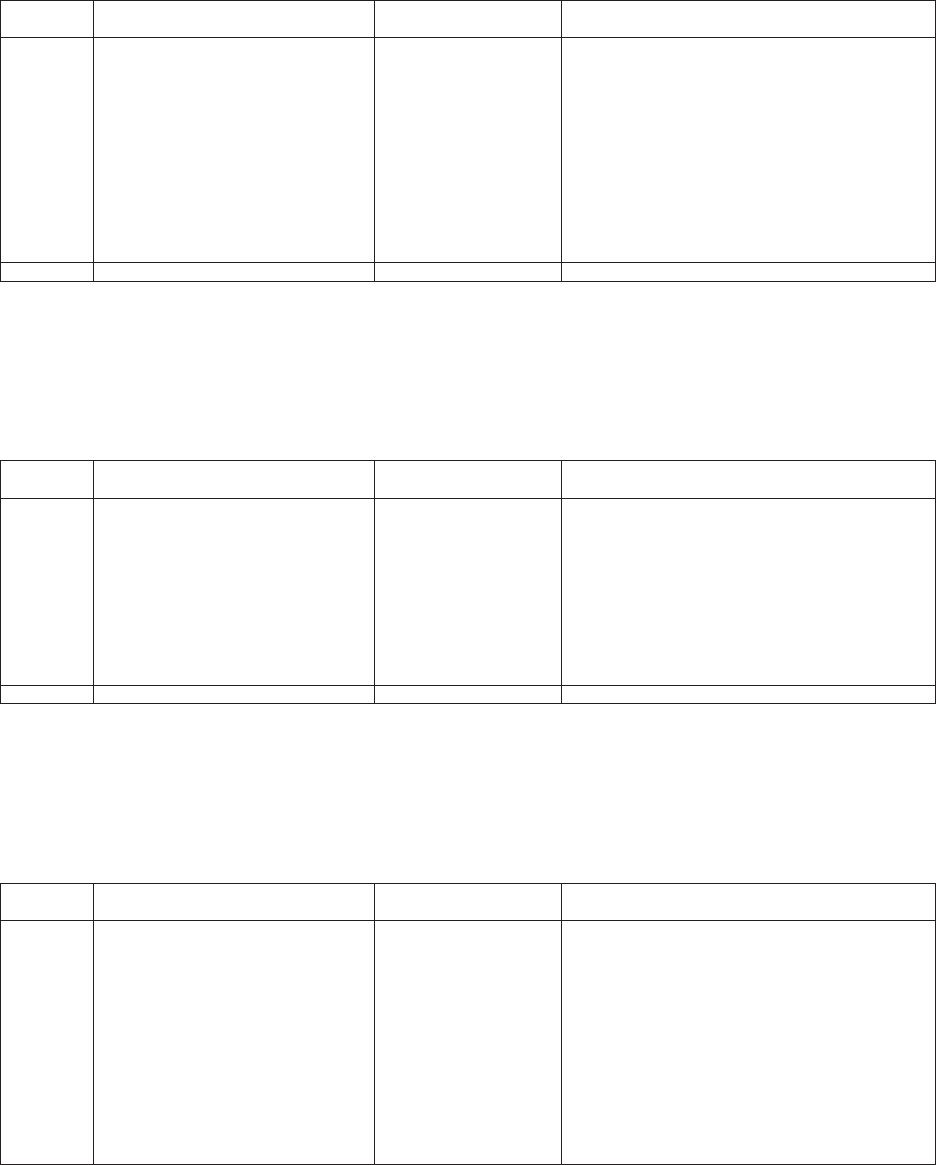

Start with a triangle array of cumulative data:

d

1 2 3 . . . n–1 n

w 1 c(1, 1) c(1, 2) c(1, 3) . . .

c(1, n-1)

c(1, n)

2 c(2, 1) c(2, 2) c(2, 3) . . .

c(2, n-1)

3 c(3, 1) c(3, 2) c(3, 3) . . .

. . . . . . . . .

n–1

c(n-1, 1) c(n-1, 2)

n c(n, 1)

A typical deterministic analysis of this data will start with an array of development

ratios or development factors:

()

()

()

=

−

Fwd

cwd

cwd

,

,

,1

.(

3.1)

en two key assumptions are made in order to make a projection of the known

elements to their respective ultimate values. First, it is assumed that each accident year

has the same development factor. Equivalently, for each w = 1, 2, . . . , n:

()()

=

FwdFd,.

Under this rst assumption, one of the more popular estimators for the development

factor is the weighted average:

∑

∑

()

()

()

=

−

=

−+

=

−+

Fd

cwd

cwd

w

nd

w

nd

ˆ

,

,1

.(

3.2)

1

1

1

1

Casualty Actuarial Society 7

Using the ODP Bootstrap Model: A Practitioner’s Guide

Certainly there are other popular estimators in use, but they are beyond our scope at

this stage yet most are still consistent with our rst assumption that each accident year

has the same factor. Projections of the ultimate values, or c

(w, n) for w = 1, 2, . . . , n are

then computed using:

∏

()() ()

==

−+

=+

cwncwd Fi dnw

id

n

ˆ

,,

ˆ

,for all1

.(

3.3)

1

is part of the claim projection algorithm relies explicitly on the second assumption,

namely that each accident year has a parameter representing its relative level. ese level

parameters are the current cumulative values for each accident year, or c(w, n - w + 1).

Of course variations on this second assumption are also common, but the point is that

every model has explicit assumptions that are an integral part of understanding the

quality of that model.

One variation on the second assumption is to assume that the accident years are

completely homogeneous.

7

In this case we would estimate the level parameter of the

accident years using:

∑

()

−+

=

−+

cwd

nd

w

nd

,

1

.(

3.4)

1

1

Complete homogeneity implies that the observations c(1, d ), c(2, d ), . . . ,

c(n - d + 1, d) are generated by the same mechanism. us, the column averages from

(3.4) would replace the last actual values along the diagonal to calculate an estimate

assuming homogeneity of accident years.

Interestingly, the basic chain ladder algorithm treats the processes generating the

observations as NOT homogeneous

8

and eectively that “pooling” of the data does not

provide any increased eciency.

9

In contrast, it could be argued that the Bornhuetter-

Ferguson (1972) and Cape Cod methods are a “blend” of these two extremes as the

homogeneity of the future expected result depends on the consistency of the a priori

loss ratios and decay rate, respectively.

3.1. Origins of Bootstrapping

Possibly the earliest development of a stochastic model for the actuarial array of

cumulative development data is attributed to Kremer (1982) and the earliest discussion

of bootstrapping is in Ashe (1986). e basic model used by Kremer is described by

England and Verrall (1999) and Zehnwirth (1989), so there will be no further elaboration

here. It should be noted, however, that this model can be extended by considering

alternatives which are discussed in Barnett and Zehnwirth (2000) and Zehnwirth

(1994), Renshaw (1989), Christodes (1990), and Verrall (1991; 2004), among others.

7

Homogeneous data can have a dierent meaning in mathematics, but here we are dening it to mean having

consistent or the same underlying exposures.

8

Meaning the underlying exposures are changing over time and thus the current cumulative results (observation)

for each year are more appropriate for projecting an estimate.

9

For a more complete discussion of these assumptions of the basic chain ladder model see Zehnwirth (1989).

8 Casualty Actuarial Society

Using the ODP Bootstrap Model: A Practitioner’s Guide

10

Generalized Linear Modeling can be done with and without link functions and with a variety of error distributions.

We are only describing here the particular GLM model that leads to the replication of the chain ladder results.

For a more complete treatise on Generalized Linear Modeling, see McCullagh and Nelder (1989).

11

Some authors refer to this as the standard deviation of the posterior distribution.

12

While over-dispersed Poisson, or ODP, are commonly used terms for this model, it is certainly possible for the

scale parameter to be less than one and thus “under-dispersed” Poisson would be more technically correct in that

case. Alternatively, the more general term quasi-Poisson could be used. In addition, we note that the z parameter in

equation 3.5, and some later formulas, could be removed for simplicity since the primary focus of this monograph is

the ODP Bootstrap model, but it is included so we do not lose sight of the fact that the ODP Bootstrap model

is a specialized case of a larger family of models.

3.2. The Over-Dispersed Poisson Model

e genesis of this model into an ODP bootstrap framework originated with

Renshaw and Verrall (1994) when they proposed modeling the incremental claims

q(w, d ) directly as the response, with the same linear predictor as Kremer (1982), but

using a generalized linear model (GLM) with a log-link function and an over-dispersed

Poisson (ODP) error distribution.

10

en, England and Verrall (1999) discuss how a

specic form of this model is identical to the volume weighted chain ladder model, and

use bootstrapping (sampling the residuals with replacement) to estimate a distribution

of point estimates

11

instead of simulating from a multivariate normal distribution for a

GLM. More formally, the following formulas are used to parameterize the GLM.

[] [][]

() () ()

==φ=φEqwd mVar qwdEqwdm

wd wd

z

,and ,, (3.5)

,,

[]

=ηm

wd wd

ln (3.6)

,,

η=+α +β == α=β=,where:1,2,...,; 1, 2,...,;and0.(3.7)

, 11

cwnd n

wd wd

In this case the a parameters function as adjustments to the constant, c, level

parameter and the b parameters adjust for the development trends after the rst

development period. e power, z, is used to specify the error distribution with:

z = 0 for Normal,

z = 1 for Poisson,

z = 2 for Gamma, and

z = 3 for inverse Gaussian.

us, the z parameter species not only the mean-variance relationship, but the

whole shape of the distribution, including higher moments. Alternatively, we can

remove the constant, c, which will cause the a parameters to function as individual

level parameters while the b parameters continue to adjust for the development trends

after the rst development period:

η=α+β= =,where:1,2,...,;and2,3,...,. (3.8)

,

wndn

wd wd

Standard statistical software can be used to estimate parameters and goodness of t

measures. e parameter f is a scale parameter that is estimated as part of the tting

procedure while setting the variance proportional to the mean (thus “over-dispersed”

Poisson for z = 1)

12

. For educational purposes, the calculations to solve these equations

Casualty Actuarial Society 9

Using the ODP Bootstrap Model: A Practitioner’s Guide

for a 10 × 10 triangle are included in the “Bootstrap Models.xlsm” le, but here, and

in the “GLM Framework.xlsm” le, the calculations are illustrated for a 3 × 3 triangle

for ease of exposition. Consider the following incremental data triangle:

1 2 3

1 q(1, 1) q(1, 2) q(1, 3)

2 q(2, 1) q(2, 2)

3 q(3, 1)

In order to set up the GLM model to t parameters to the data we need to do a

log-link or transform which results in:

1 2 3

1 ln[q(1, 1)] ln[q(1, 2)] ln[q(1, 3)]

2 ln[q(2, 1)] ln[q(2, 2)]

3 ln[q(3, 1)]

e model, as described in (3.8), is then specied using a system of equations with

vectors of a

w

and b

d

parameters as follows:

[]

[]

[]

[]

[]

[]

()

()

()

()

()

()

=α+α+α+β+β

=α+α+α+β+β

=α+α+α+β+β

=α+α+α+β+β

=α+α+α+β+β

=α+α+α+β+β

q

q

q

q

q

q

ln 1, 11 0000

ln 2,10 1000

ln 3,10 0100

ln 1, 21 0010

ln 2, 20 1010

ln 1, 31 0011

.(

3.9)

12323

12 323

12323

1232 3

12 32 3

12323

Converting this to matrix notation we have:

YXA(3.10)=×

Where:

[]

[]

[]

[]

[]

[]

()

()

()

()

()

()

=

Y

ln 1, 1

ln 2,1

ln 3,1

ln 1, 2

ln 2, 2

ln 1, 3

,(

3.11)

q

q

q

q

q

q

10 Casualty Actuarial Society

Using the ODP Bootstrap Model: A Practitioner’s Guide

X

1 0000

01000

00100

10010

01010

10011

,and (3.12)=

=

α

α

α

β

β

A. (3.13)

1

2

3

2

3

In this form we can use iteratively weighted least squares or maximum likelihood

13

to solve for the parameters in the A vector (3.13) that minimize the squared dierence

between the Y matrix (3.11) and the solution matrix (3.14):

[]

[]

[]

[]

[]

[]

ln

ln

ln

ln

ln

ln

.(

3.14)

1,1

2,1

3,1

1,2

2,2

1,3

m

m

m

m

m

m

After solving the system of equations we will have:

[]

[]

[]

[]

[]

[]

=η =α

=η =α

=η =α

=η =α +β

=η =α +β

=η =α +β +β

ln

ln

ln

ln

ln

ln .(3.15)

1,11,1 1

2,12,1 2

3,13,1 3

1,21,2 12

2,22,2 22

1,31,3 123

m

m

m

m

m

m

is solution can then be shown as a triangle:

1 2 3

1 ln[m

1,1

] ln[m

1,2

] ln[m

1,3

]

2 ln[m

2,1

] ln[m

2,2

]

3 ln[m

3,1

]

13

Other methods, such as orthogonal decomposition or Newton-Raphson, can also be used to solve for the parameters.

Iteratively weighted least squares and maximum likelihood are both illustrated in the companion Excel les.

Casualty Actuarial Society 11

Using the ODP Bootstrap Model: A Practitioner’s Guide

ese results can then be exponentiated to produce the tted, or expected, incremental

results of the GLM model:

1 2 3

1 m

1,1

m

1,2

m

1,3

2 m

2,1

m

2,2

3 m

3,1

is monograph will refer to this as the “GLM framework” and it is illustrated for

a simple 3 × 3 triangle in the “GLM Framework.xlsm” le. While the GLM framework

is used to solve these equations for the tted results, the usefulness of this framework

is that the tted incremental values (with the Poisson error distribution assumption)

will equal the incremental values that can be derived from volume-weighted average

development factors, as shown in the “GLM Framework.xlsm” le.

14

at is, it can be

reproduced by using the last cumulative diagonal, dividing backwards successively by

each volume-weighted average development factor and subtracting to get the tted

incremental results. is monograph will refer to this method as the “simplied GLM”

or “ODP Bootstrap.” is has three very useful consequences.

First, the GLM portion of the algorithm can be replaced with a simpler development

factor algorithm while still being based on the underlying GLM framework. Second,

the use of the development factors serves as a “bridge” to the deterministic framework

and allows the model to be more easily explainable to others. And, third, for the GLM

algorithm the log-link process means that negative incremental values can often cause

the algorithm to not have a solution, whereas using development factors will generally

allow for a solution.

15

With a model tted to the data, the ODP bootstrap process involves sampling

with replacement from the residuals. England and Verrall (1999) note that the

deviance, Pearson, and Anscombe residuals could all be considered for this process,

but the Pearson residuals are the most desirable since they are calculated consistently

with the scale parameter. e unscaled Pearson residuals, r

w,d

, and scale parameter, f,

are calculated as follows:

()

=

−,

.(

3.16)

,

,

,

r

qwdm

m

wd

wd

wd

z

∑

φ=

−

r

Np

wd

.(

3.17)

,

2

14

Using other than the Poisson assumption (i.e., z ≠ 1), the incremental values may be close to the values from

the development factors, but they will not be equal.

15

More specically, individual negative cell values may not be a problem (by using the negative of the log of the

absolute value in 3.14). If the total of all incremental cell values in a development column is negative, then the

GLM algorithm will fail. is situation will not cause a problem tting the model as a link ratio less than one

will be perfectly useful. However, this may still cause other problems, e.g., the “GLM framework” and “simplied

GLM” may not be equivalent, which we will address in Section 4.

12 Casualty Actuarial Society

Using the ODP Bootstrap Model: A Practitioner’s Guide

Where N = the number of observations, or incremental data cells in the triangle,

which is typically equal to n × (n + 1) ÷ 2, and p = the number of parameters, which

is typically equal to 2 × (n - 1).

16

Sampling with replacement from the residuals can

then be used to create new sample triangles of incremental values using formula 3.18.

Sampling with replacement assumes that the residuals are independent and identically

distributed, but it does not require the residuals to be normally distributed. Indeed, this

is often cited as an advantage of the ODP bootstrap model since whatever distributional

form the residuals have will ow through to the simulation process. Some authors have

referred to this as a “semi-parametric” bootstrap model since we are not parameterizing

the residuals.

=× +*( ,) *. (3.18)

,,

qwdr mm

wd

z

wd

e sample triangle of incremental values can then be cumulated, new average

development factors can be calculated for the sample and applied to calculate a point

estimate for this data, resulting in a distribution of point estimates for some large number

of samples. In England and Verrall (1999) this is the end of the process, but at the

end of the appendix they note that you should also adjust the resulting distribution

by the degrees of freedom adjustment factor (3.19) and the Scale Parameter (3.17), to

eectively allow for over-dispersion of the residuals in the sampling process and add

process variance to approximate a distribution of possible outcomes.

=

−

.(

3.19)f

N

Np

DoF

Later, in England and Verrall (2002), the authors note that the Pearson residuals

(3.16) could be multiplied by the degrees of freedom adjustment factor (3.19) to include

the over-dispersion in the residuals. As calculated in (3.20), these adjusted residuals

are referred to as scaled Pearson residuals. ey also expand the simulation process

by adding process variance to the future incremental values from the point estimates.

To add this process variance, they assume that each future incremental value m

w,d

is

the mean and the mean times the scale parameter, fm

w,d

, is the variance of a gamma

distribution.

17

is revised model could now be described as estimating a distribution

of possible outcomes, which incorporates process variance and parameter variance in the

simulation of the historical and future data.

18

16

e number of data cells could be less than n × (n + 1) ÷ 2 and the number of parameters could be less than

2 × (n - 1). For example, if the incremental values are zeros for the last three columns in a triangle then these cells

would not be included in the total for N and there will be three fewer b parameters since none are needed to t

to these zero values as the development process is completed already.

17

e Poisson distribution could be used to remain more consistent with the underlying theory of the GLM

framework, but it is considerably slower to simulate, so gamma is a close substitute that performs much faster in

simulation although it can be more skewed than the Poisson. Indeed, other distributions could be used as well to

better approximate the observed “skewness” of the residuals from the diagnostics.

18

Some authors refer to this as the full predictive distribution of the cash ows.

Casualty Actuarial Society 13

Using the ODP Bootstrap Model: A Practitioner’s Guide

()

=

−

×

,

.(

3.20)

,

,

,

r

qwdm

m

f

wd

S

wd

wd

z

DoF

However, Pinheiro et al. (2001; 2003) noted that the bias correction for the residuals

using the degrees of freedom adjustment factor (3.20) does not create standardized

residuals, which is an important step for making sure that the residuals all have the

same variance. In order to have standardized Pearson residuals, the GLM framework

requires the use of a hat matrix adjustment factor (3.23).

()

=

−

.(

3.21)

1

HXXWXXW

TT

First, the hat matrix (3.21) is calculated using matrix multiplication of the design

matrix (3.12) and the weight matrix (3.22).

=

00000

00000

00 000

00000

0 000 0

0 0000

(3.22)

1,1

2,1

3,1

1,2

2,2

1,3

W

m

m

m

m

m

m

=

−

1

1

.(

3.23)

,

,

f

H

wd

H

ii

e hat matrix adjustment factor (3.23) uses the diagonal of the hat matrix (3.21). In

Pinheiro et al. (2003) the authors note two important points about the ODP bootstrap

process as described by England and Verrall (1999; 2002). First, the sampling of the

residuals should not include any zero-value residuals, which are typically in the corners of

the triangle.

19

e exclusion of the zero-value residuals is accounted for in the hat matrix

adjustment factor (3.23), but another common explanation is that the zero-value cells

will have some variance but we just don’t know what it is yet so we should sample from

the remaining residuals but not the zeros. Second, the hat matrix adjustment factor (3.23)

is a replacement for, and an improvement on, the degrees of freedom factor (3.19).

20

us, the scaled Pearson residuals (3.20) should be replaced by the standardized

Pearson residuals:

()

=

−

×

,

.(

3.24)

,

,

,

,

r

qwdm

m

f

wd

H

wd

wd

z

wd

H

19

Technically, the two “corner” residuals are zero because they each have a parameter that is unique to that incremental

value which causes the tted incremental value to exactly equal the actual incremental value.

20

is second point was not addressed clearly in Pinheiro et al. (2001), but as the authors updated and claried the

monograph in Pinheiro et al. (2003) this issue was more clearly addressed.

14 Casualty Actuarial Society

Using the ODP Bootstrap Model: A Practitioner’s Guide

However, the scale parameter (3.17) is still calculated as before, although the

standardized Pearson residuals could be used to approximate the scale parameter as

follows:

∑

()

φ=

.(

3.25)

,

2

r

N

H

wd

H

At this point we have a complete basic “ODP bootstrap” model, as it is often

referred to. It is also important to note that the two key assumptions mentioned

earlier, each accident year has the same development factor and each accident year has

a parameter representing its relative level, are equally applicable to this model.

In order for the reader to test out the dierent “combinations” of this modeling

process the “Bootstrap Models.xlsm” le includes options to allow these historical

algorithms to be simulated. e purpose for describing this evolution of the ODP

bootstrap model framework is threefold: rst, to allow the interested reader to better

understand the details of the algorithm and how these papers and their authors have

contributed to the evolution of this model framework; second, to illustrate the value of

collaborative research via dierent published papers and the contributions of dierent

authors; and, third, to provide a solid foundation for continuing the evolutionary

process and to discuss practical adjustments.

3.3. Variations on the ODP Model

When estimating insurance risk it is generally considered desirable to focus on the

claim payment stream in order to measure the variability of the actual cash ows that

directly aect the bottom line. Clearly, changes in case reserves and IBNR reserves

will also impact the bottom line, but to a considerable extent the changes in IBNR are

intended to counter the impact of the changes in case reserves. To some degree, then,

the total reserve movements can act to mask the underlying changes due to cash ows.

On the other hand, the case reserves contain valuable information about potential

future payments so we should not ignore them and use only paid data.

3.3.1. Bootstrapping the Incurred Loss Triangle

e ODP bootstrap model can be used to model both paid and incurred loss data.

Using incurred data incorporates case reserves, thus perhaps improving the ultimate

estimates. However, the resulting distribution from using incurred data will be possible

outcomes of the IBNR, not a distribution of the unpaid.

21

ere are two possible

approaches for modeling an unpaid loss distribution using incurred loss data: modeling

incurred data and convert the ultimate values to a payment pattern, or, modeling paid

and case reserves separately.

Using the rst approach, a convenient way of converting the results of an incurred

data model to a payment stream is to run the paid data model in parallel with the

21

Using incurred data will also create issues in weighting the results of dierent models which will be discussed in

Section 6.

Casualty Actuarial Society 15

Using the ODP Bootstrap Model: A Practitioner’s Guide

incurred data model, and use the random payment pattern from each iteration from

the paid data model to convert the ultimate values from each corresponding iteration

from the incurred data to a payment pattern for each iteration (for each accident year

individually). e “Bootstrap Models.xlsm” le illustrates this concept. It is worth

noting, however, that this process allows the “added value” of using the case reserves

to help predict the ultimate results to work its way into the calculations, thus perhaps

improving the ultimate estimates, while still focusing on the payment stream for

measuring risk. In eect, it allows a distribution of IBNR to become a distribution of

IBNR and case reserves. is process could be made more sophisticated by correlating

some part of the paid and incurred models (e.g., the residual sampling and/or process

variance portions), but that is beyond the scope of this monograph.

e second approach could be accomplished by applying the ODP bootstrap to

the Munich chain ladder model. is has the advantage over the rst approach of not

modeling the paid losses twice, and of explicitly measuring and imposing a framework

around the correlation of the paid and outstanding losses. Since it is so well detailed in

Liu and Verrall (2010), it will not be discussed in detail here.

3.3.2. Bootstrapping the Bornhuetter-Ferguson

and Cape Cod models

Another common issue with using the ODP bootstrap model is that the distribution

for the most recent accident years can produce results with more variance than you

would expect when compared to earlier accident years. is is usually because more

development factors are used to extrapolate the sampled values for the most recent

accident years which, when coupled with random samples of incremental values, can

result in more extreme uctuations in point estimates. is is analogous to one of

the weaknesses of the deterministic paid chain ladder method—a low, or high, initial

observation can lead to an abnormally low, or high, projected ultimate, respectively.

To help alleviate this problem, the Bornhuetter-Ferguson (1972) or generalized

Cape Cod (Struzzieri and Hussian 1998) deterministic methods can be worked into

the underlying ODP bootstrap model, and the deterministic assumptions of these

methods can also be converted to stochastic assumptions. For example, instead of

using deterministic a priori loss ratios for the Bornhuetter-Ferguson model, the a priori

loss ratios can be simulated from a distribution. Similarly, the Cape Cod algorithm can

be applied to every ODP bootstrap model iteration to produce a stochastic Cape Cod

projection that reects the unique characteristics of each sample triangle.

22

e “Bootstrap Models.xlsm” le also illustrates these Bornhuetter-Ferguson and

Cape Cod ODP bootstrap models.

23

22

In addition to being consistent between paid and incurred data, to the extent there is commonality with

deterministic methods the assumptions should also be consistent. For example, it would not make sense to use

one set of a priori loss ratio assumptions for a deterministic Bornhuetter-Ferguson method and a dierent set of

mean assumptions for a modied ODP bootstrap model.

23

More complex implementations of these models could include modifying the underlying assumptions of the

GLM framework which would result in a completely dierent set of residuals, but that is beyond the scope of

this monograph.

16 Casualty Actuarial Society

Using the ODP Bootstrap Model: A Practitioner’s Guide

3.4. The GLM Bootstrap Model

Two limitations of the chain-ladder model, and hence the ODP bootstrap of the

chain-ladder model, is that it does not measure or adjust for calendar-year eects, and

it includes a signicant number of parameters and many would argue that it over-ts

the model to the data.

Another approach is to go back to the original GLM framework. Returning to

formulas (3.5) to (3.8), the GLM framework does not require a certain number of

parameters so we are free to specify only as many parameters as we need to get a robust

model, which can address the over-tting issue. Indeed, it is ONLY when we specify

a parameter for EVERY accident year and EVERY development year and specify a

Poisson error distribution that we end up exactly replicating the volume weighted

average development factors that allow us to substitute the deterministic algorithm

instead of solving the GLM t.

us, using the original GLM framework, which this monograph will refer to as

the “GLM Bootstrap” model, we can specify a model with only a few parameters, but

there are two drawbacks to doing so.

24

First, the GLM must be solved for each iteration

of the bootstrap model (which may slow down the simulation process) and, second, the

model is no longer directly explainable to others using development factors.

25

While

the impact of these drawbacks should be considered, the potential benets of using the

GLM bootstrap can be much greater.

First, having fewer parameters will help avoid over-parameterizing the model.

26

For

example, if we use only one accident year parameter then the model specied using a

system of equations is as follows (which is analogous to formula 3.9):

[]

[]

[]

[]

[]

[]

()

()

()

()

()

()

=α+β+β

=α+β+β

=α+β+β

=α+β+β

=α+β+β

=α+β+β

q

q

q

q

q

q

ln 1, 11 00

ln 2,11 00

ln 3,11 00

ln 1, 2110

ln 2, 2110

ln 1, 3111 (3.26)

123

123

123

12 3

12 3

123

In this case we will only have one accident year parameter and n - 1 develop-

ment trend parameters, but it will only be coincidence that we would end up with the

equivalent of average development factors. Interestingly, this model parameterization

moves us away from one of the common basic assumptions (i.e., each accident year has

its own level) and substitutes the assumption that all accident years are homogeneous.

24

Using the GLM framework allows for many other variations in the specication of models and then bootstrapping

as described in more detail in England and Verrall (1999; 2002) and others, but this monograph will focus on

variations consistent with the framework underpinning the ODP bootstrap model.

25

However, age-to-age factors could be calculated for the tted data to compare to the actual age-to-age factors and

used as an aid in explaining the model to others.

26

Over-parameterization will be addressed more completely in Section 5.

Casualty Actuarial Society 17

Using the ODP Bootstrap Model: A Practitioner’s Guide

Another example of using fewer parameters would be to only use one development

year parameter (while continuing to use an accident-year parameter for each year),

which would equate to the system of equations in (3.27).

[]

[]

[]

[]

[]

[]

()

()

()

()

()

()

=α+α+α+β

=α+α+α+β

=α+α+α+β

=α+α+α+β

=α+α+α+β

=α+α+α+β

q

q

q

q

q

q

ln 1, 11 000

ln 2,10 100

ln 3,10 010

ln 1, 21001

ln 2, 20101

ln 1, 31 00

2(

3.27)

1232

12 32

1232

1232

12 32

1232

In this example the model parameterization moves away from the other common

basic assumption (i.e., each accident year has its own level, but the same development

parameter is used for all periods), and again it would be pure coincidence to end up

with the equivalent of average development factors.

27

It is also interesting to note that

for both of these two examples there will be one additional non-zero residual that can

be used in the simulations because in each case one of the incremental values no longer

has a unique parameter—i.e., for (3.26) q(3, 1) is no longer uniquely dened by a

3

,

and for (3.27) q(1, 3) is no longer uniquely dened by b

3

.

Of course we can take this simplication to its logical extreme and use a model

with only one accident year parameter and one development year parameter, which

would result in the system of equations in as shown in (3.28).

[]

[]

[]

[]

[]

[]

()

()

()

()

()

()

=α+β

=α+β

=α+β

=α+β

=α+β

=α+β

q

q

q

q

q

q

ln 1, 11 0

ln 2,11 0

ln 3,11 0

ln 1, 211

ln 2, 211

ln 1, 31

2(

3.28)

12

12

12

12

12

12

In this example the model parameterization moves away from both of the common

basic assumptions (i.e., each accident year has its own level, and the dierent development

parameter is used for all periods), and again it would be pure coincidence to end up

with the equivalent of average development factors. In this most “basic” model it is

interesting to note that both of the “zero residuals” will now be non-zero and can be

used in the simulations because both corners no longer have a unique parameter.

is exibility allows the modeler to use enough parameters to capture the

statistically relevant level and trend changes in the data without forcing a specic

number of parameters.

28

27

While we have only one parameter to describe the development period trends, if we convert these to development

factors there will be a dierent factor for each period.

28

How to determine which parameters are statistically relevant will be discussed in Section 5.

18 Casualty Actuarial Society

Using the ODP Bootstrap Model: A Practitioner’s Guide

e second benet, and depending on the data perhaps the most signicant, is

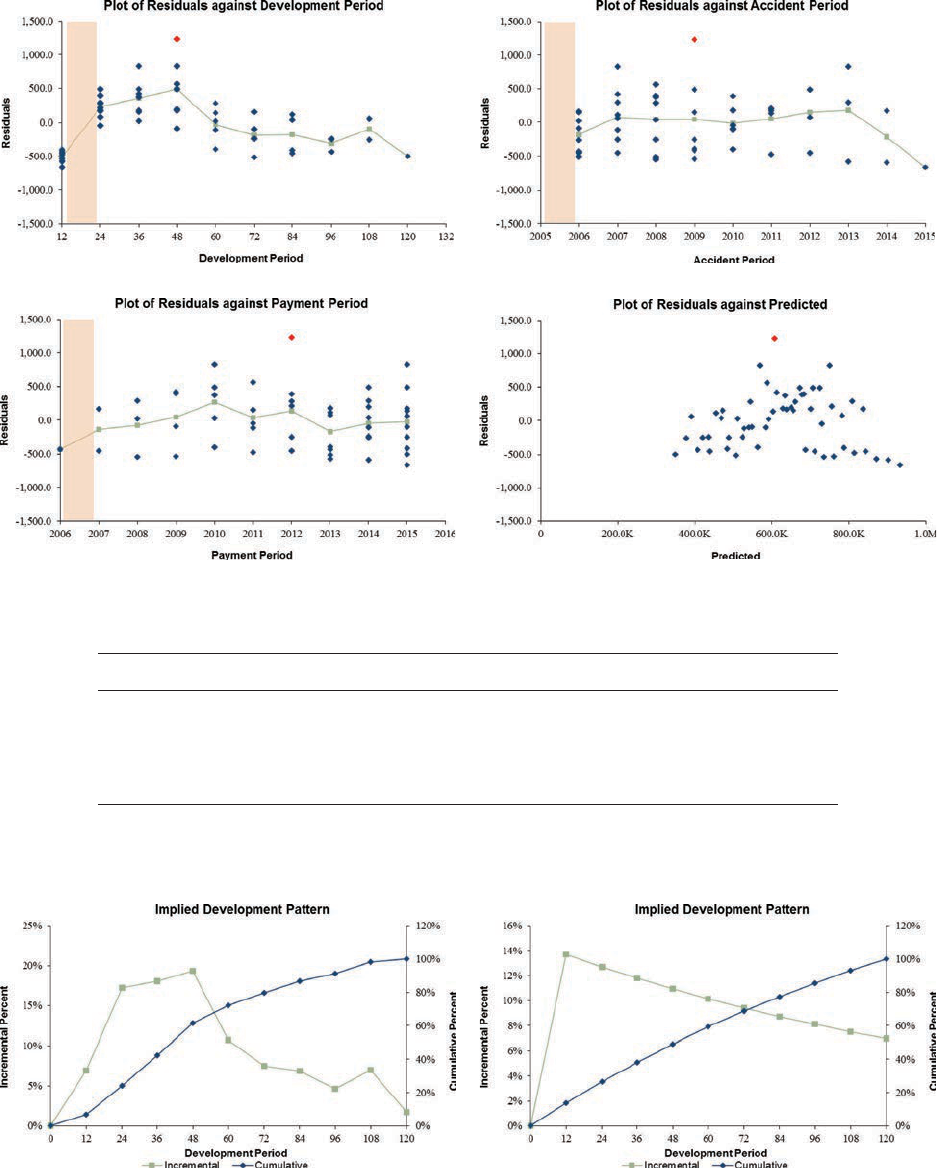

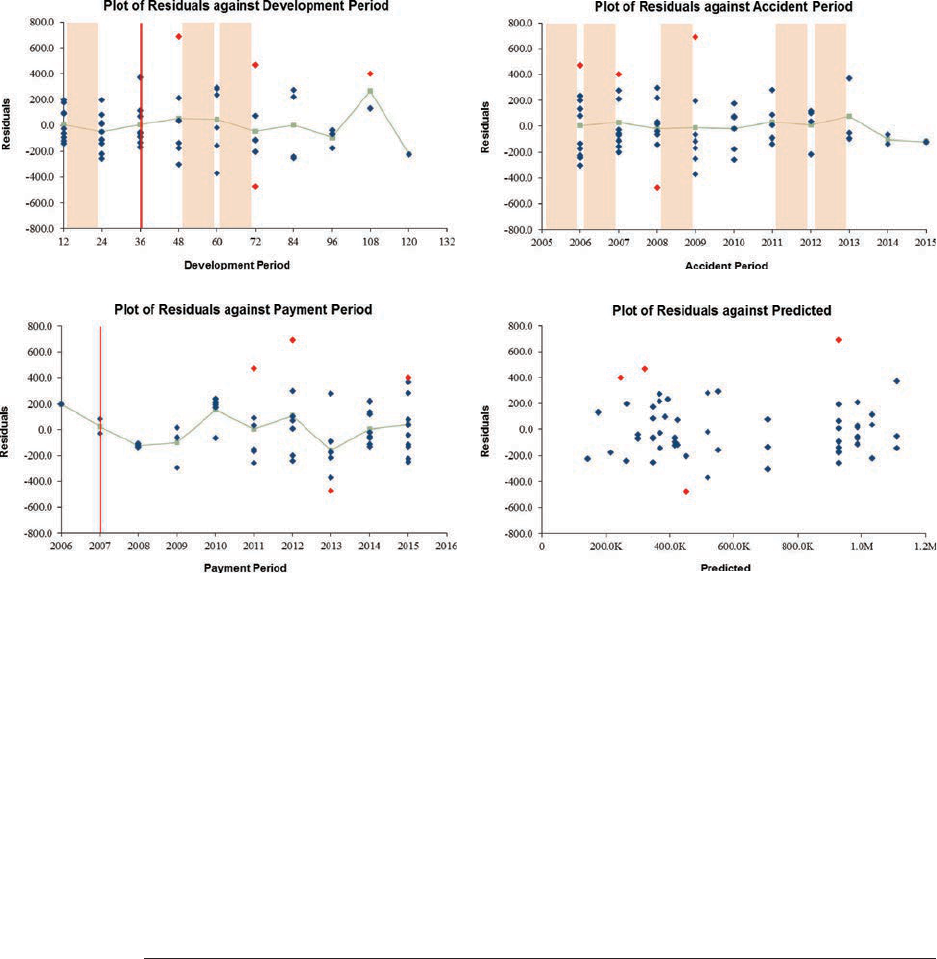

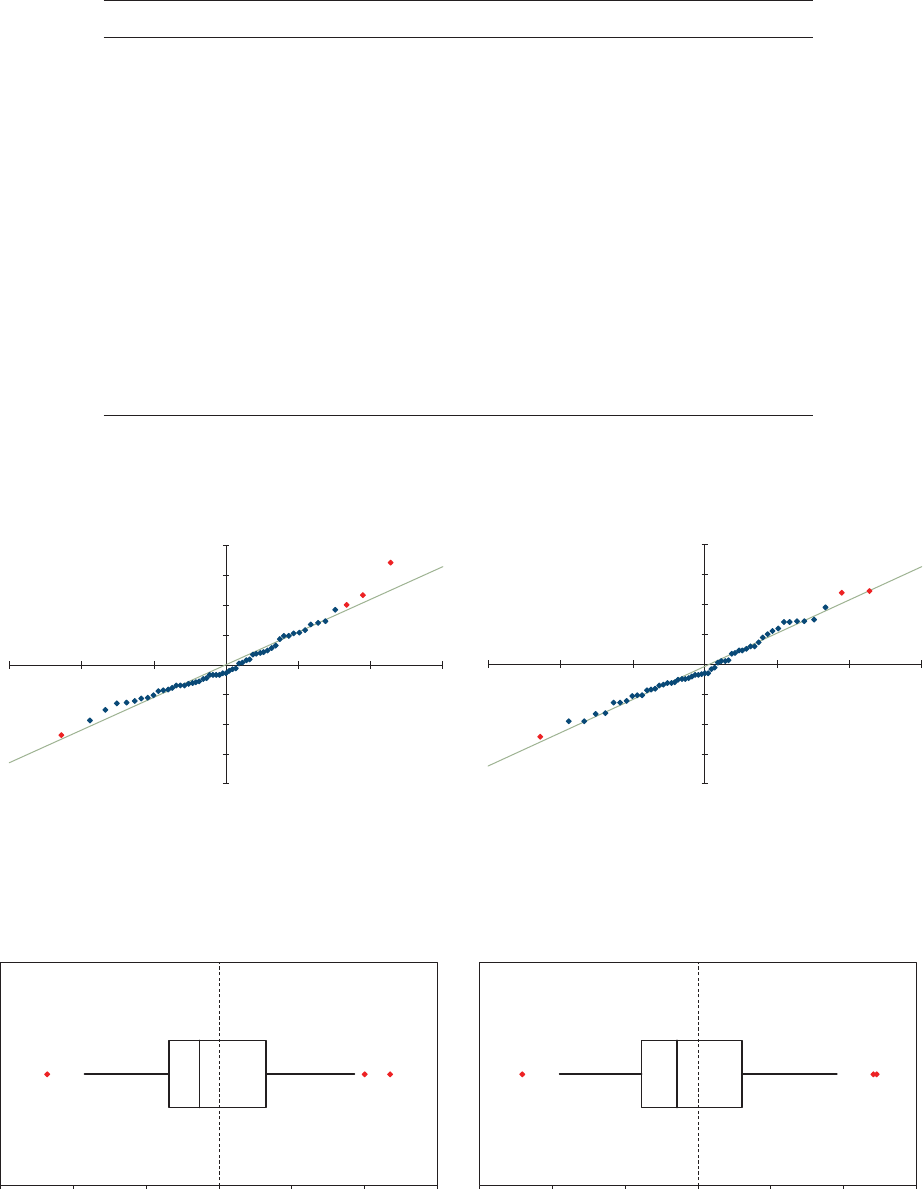

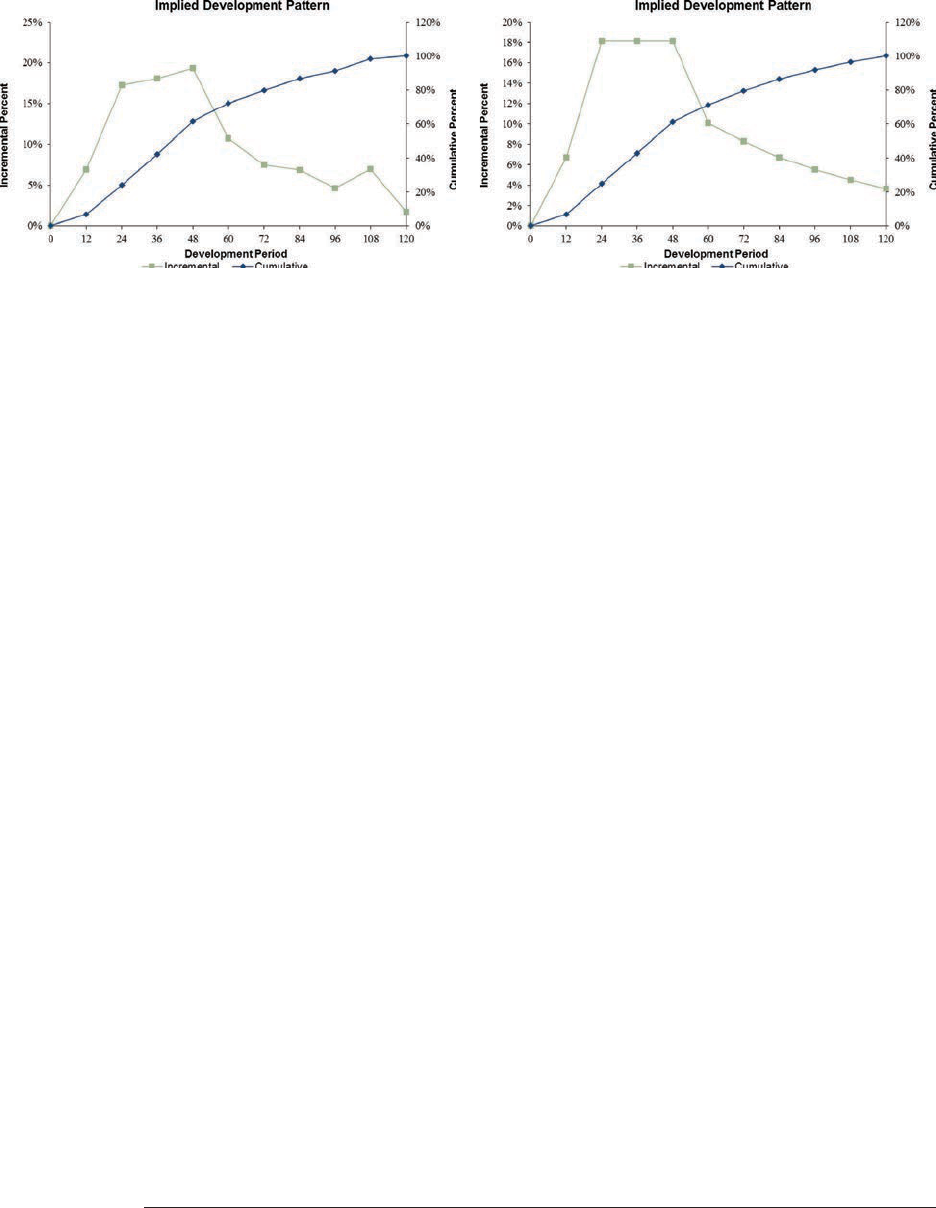

that this framework aords us the ability to add parameters for calendar-year trends.

Adding diagonal, or calendar year trend, parameters to (3.8) we now have:

η=α+β+γ= =

=

wndn

kn

wd wdk

,where:1,2,...,; 2, 3,...,;

and2,3,...,. (3.29)

,

A complete system of equations for the (3.29) framework would look like the

following:

[]

[]

[]

[]

[]

[]

()

()

()

()

()

()

=α+α+α+β+β+γ+γ

=α+α+α+β+β+γ+γ

=α+α+α+β+β+γ+γ

=α+α+α+β+β+γ+γ

=α+α+α+β+β+γ+γ

=α+α+α+β+β+γ+γ

q

q

q

q

q

q

ln 1, 11 000000

ln 2,10 100010

ln 3,10 010011

ln 1, 21001010

ln 2, 20101011

ln 1, 31 001111 (3.3

0)

1232323

12 32323

1232323

1232 32 3

12 32 323

1232323

However, there is no unique solution for a system with seven parameters and six

equations, so some of these parameters will need to be removed. A logical starting

point would be to start with a “basic” model with one accident year (level) parameter,

one development trend parameter and one calendar trend parameter and then add

or remove parameters as needed.

29

e system of equations for this basic model is as

follows:

[]

[]

[]

[]

[]

[]

()

()

()

()

()

()

=α+β+γ

=α+β+γ

=α+β+γ

=α+β+γ

=α+β+γ

=α+β+γ

q

q

q

q

q

q

ln 1, 11 00

ln 2,1 101

ln 3,11 02

ln 1, 2111

ln 2, 2112

ln 1, 31 22 (3.31)

122

122

12 2

122

12 2

122

A third benet of the GLM bootstrap model is that it can be used to model data

shapes other than triangles. For example, missing incremental data for the rst few

diagonals would mean that the cumulative values could not be calculated and the

remaining values in those rst few rows would not be useful for the ODP bootstrap.

However, since the GLM bootstrap uses the incremental values the entire trapezoid

can be used to t the model parameters.

30

29

A simple algorithm to add and/or remove parameters in a search for the “optimal” set of parameters is included

in the “Bootstrap Models.xlsm” le, but more complex algorithms are outside the scope of this monograph.

We focus on the “mechanical” aspects of searching for the “optimal” set of parameters in Section 5 in order to

enhance the educational benets.

30

is issue will be examined in more detail in Section 4.

Casualty Actuarial Society 19

Using the ODP Bootstrap Model: A Practitioner’s Guide

It should also be noted that the GLM bootstrap model allows the future expected

values to be directly estimated from the parameters of the model for each sample

triangle in the bootstrap simulation process. However, we must solve the GLM within

each iteration for the same parameters as we originally set up for the model rather than

using development factors to project future expected values (which is a way of tting

the model to each sample triangle).

e additional modeling power that this exible GLM bootstrap model adds to

the actuary’s toolkit cannot be overemphasized. Not only does it allow one to move

away from the two basic assumptions of a deterministic chain ladder method, it allows

for the ability to match the model parameters to the statistical features you nd in the

data, rather than “force” the data to t the model, often with far fewer parameters and

to extrapolate those features. For example, modeling with fewer development trend

parameters means that the last parameter can be assumed to continue past the end of

the triangle which will give the modeler a “tail” of the incremental values beyond the

end of the triangle without the need for a specic tail factor.

While the monograph continues to illustrate the GLM bootstrap with a 3 × 3

triangle, also included in the companion Excel les are a set of “GLM Bootstrap

6___.xlsm” les that illustrate the calculations for these dierent models using a 6 ×

6 triangle. Also, the “Bootstrap Models.xlsm” le contains a “GLM bootstrap” model

for a 10 × 10 triangle that can be used to specify any combination of accident year,

development year, and calendar year parameters, including setting parameters to zero.

e GLM bootstrap model is akin to the incremental log model described in Barnett

and Zehnwirth (2000), so we will leave it to the reader to explore this exibility by

using the Excel le.

20 Casualty Actuarial Society

4. Practical Issues

Now that the basic ODP bootstrap model has been expanded in a variety of ways, it

is important to address some of the key assumptions of the ODP model and some

common data issues.

4.1. Negative Incremental Values

As noted in Section 3.2, because of the log-link used in the GLM framework

the incremental values must be greater than zero in order to parameterize a model.

However, a slight modication to the log-link function will help this common

problem become a little less restrictive. If we use (4.1) as the log-link function, then

individual negative values are only an issue if the total of all incremental values in

a development column is negative, as the GLM algorithm will not be able to nd a

solution in that case.

[]

[]

{}

() ()

()

() ()

>

=

−<

ln ,for ,0,

0for ,0,

ln ,for ,0

.(

4.1)

qwdqwd

qwd

absqwd qwd

Using (4.1) in the GLM bootstrap will help in many situations, but it is quite

common for entire development columns of incremental values to be negative, especially

for incurred data. To give the GLM framework the ability to solve for a solution in this

case we need to make another modication to the basic model to include a constant.

Whenever a column or columns of incremental values sum to a negative value, we can

nd the largest negative

31

in the triangle, set y equal to the largest negative and adjust

the log-link function by making all the incremental values positive.

[]

()()

() ()

=−ψ

+

+

,,

ln ,for all, (4.2)

qwdqwd

qwdqwd

Using the adjusted log-link function (4.2) we can solve the GLM using formulas

(3.7), (3.8), or (3.27). en we use (4.3) to adjust the tted incremental values

31

e largest negative value can either be the largest negative among the sums of development columns (in which

case there may still be individual negative values in the adjusted triangle) or the largest negative incremental value

in the triangle.

Casualty Actuarial Society 21

Using the ODP Bootstrap Model: A Practitioner’s Guide

and the constant y is used to reduce each tted incremental value by the largest

negative.

mm

wd wd

=+ψ

+

(4.3)

,,

e combination of formulas (4.2) and (4.3) allow the GLM bootstrap to handle

all negative incremental values, which overcomes a common criticism of the ODP

bootstrap. Incidentally, these formulas can also be used to allow the incremental log

model described by Barnett and Zehnwirth (2000) to handle negative incremental

values. As long as these formulas are used sparingly, the author believes that the resulting

distribution will not be adversely aected.

When using the ODP bootstrap simulation process, the solution to negative incremental

values needs to focus on the residuals and sampled incremental values since a development

factor less than 1.00 will create negative incremental values in the tted values. More

specically, we need to modify formulas (3.16) and (3.18) as follows:

32

r

qwdm

absm

wd

wd

wd

z

{}

()

=

−

,

.(

4.4)

,

,

,

qwdr absm m

wd

z

wd

*, *.

()

,,

(

)

=×

{}

+ 45.

While the tted incremental values and residuals using the development factor

simplication (ODP bootstrap) will generally not match the GLM framework solution

using (4.1) or (4.2) and (4.3) they should be reasonably close. While the purists may

object to these practical solutions, we must keep in mind that every model is an

approximation of reality so our goal is to nd reasonably close models that replicate the

statistical features in the data rather than only restrict ourselves to “pure” models. After

all, the assumptions of the “pure” models are themselves approximations.

4.1.1. Negative Values During Simulation

Even though we have solved problems with negative values when parameterizing

a model, negative values can still aect the process variance in the simulation process.

When each future incremental value (using m

w,d

as the mean and the mean times the

scale parameter, fm

w,d

, as the variance) is sampled from a gamma distribution to add

process variance, the parameters of a gamma distribution must be positive. In this case

we have two options for using the gamma distribution to simulate from a negative

incremental value, m

w,d

.

Gamma absm absm

wd wd

[]

{} {}

−φ

,(

4.6)

,,

Gamma absm absm m

wd wd wd

[]

{} {}

φ+,2 (4.7)

,,,

32

e use of other types of residuals, as noted in Section 3.2, may also help address the issue of negative incremental

values, but their exposition is left to the interested reader.

22 Casualty Actuarial Society

Using the ODP Bootstrap Model: A Practitioner’s Guide

Using formula (4.6) is more intuitive as we are using absolute values to simulate

from a gamma distribution and then changing the sign of the result. However, since

the gamma distribution is skewed to the right, the resulting distribution using (4.6)

will be skewed to the left. Using formula (4.7) is a little less intuitive, but seems more

logical since adding twice the mean, m

w,d

, will result in a distribution with a mean of

m

w,d

while keeping it skewed to the right (since m

w,d

is negative).

Negative incremental values can also cause extreme outcomes. is is most

prevalent when resampled triangles are created with negative incremental losses in the

rst few development periods, causing one column of cumulative values to sum close

to zero and the next column to sum to a much larger number and, consequentially,

produce development factors that are extremely large. is can result in one or more

extreme iterations in a simulation (for example, outcomes that are multiples of 1,000s

of the central estimate). ese extreme outcomes cannot be ignored, even if the high

percentiles are not of interest, because they may signicantly aect the mean of the

distribution.

In these instances, you have several options. You can 1) remove these iterations

from your simulation and replace them with new iterations, 2) recalibrate your model,

or 3) limit incremental values to a minimum of zero (or some other minimum value).

e rst option is to identify the extreme iterations and remove them from your

results. Care must be taken that only truly unreasonable extreme iterations are removed,

so that the resulting distribution does not understate the probability of extreme

outcomes.

e second option is to recalibrate the model to x this issue. First you must

identify the source of the negative incremental losses. e most theoretically sound

method to deal with negative incremental values is to consider the source of these

losses. For example, it may be from the rst row in your triangle, which was the rst year

the product was written, and therefore exhibit sparse data with negative incremental

amounts. One option is to remove this row from the triangle if it is causing extreme

results and does not improve the parameterization of the model. Or, if they are caused

by reinsurance or salvage and subrogation, then you can model the losses gross of

salvage and subrogation, model the salvage and subrogation separately, and combine

the iterations assuming the values are correlated.

e third option is to constrain the model output by limiting incremental losses to a

minimum of zero, where any negative incremental is replaced with a zero incremental.

33

For each of these options, keep in mind that this is a form of diagnosing a model

by reviewing the simulated results and then searching for a practical solution before

abandoning a model altogether. is does not mean that you should never abandon

a model in favor of a practical adjustment. Indeed, the higher the frequency of the

underlying issue (negative incremental values in this case) the more likely that the

model does not really t the data.

33

While zero is a convenient minimum or lower bound, a small positive number could also be used, in which case

any values less than the minimum are changed to the minimum.

Casualty Actuarial Society 23

Using the ODP Bootstrap Model: A Practitioner’s Guide

4.2. Non-Zero Sum of Residuals

e standardized residuals that are calculated in the ODP bootstrap model are

essentially error terms, and should in theory be independent and identically distrib-

uted with a mean of zero. However, the residuals are random observations of the true

residual distribution, so the average of all the residuals is usually non-zero. If signi-

cantly dierent than zero, then the t of the model should be questioned. If the average

of the residuals is close to zero, then the question is whether they should be adjusted so

that their average is zero. For example, if the average of the residuals is positive, then

re-sampling from the residual pool will not only add variability to the resampled incre-

mental losses, but may increase the resampled incremental losses such that the average

of the resampled loss will be greater than the tted loss.

It could be argued that the non-zero average of residuals is a characteristic of the

data set, and therefore should not be removed. For example, standardized residuals

implies a normal distribution with zero mean, but skewness in the residuals does not

necessarily imply an average of zero. However, if a zero residual average is desired, then

one option is the addition of a single constant to all non-zero residuals, such that the

sum of the shifted residuals is zero.

4.3. Using an N-Year Weighted Average

It is quite common for actuaries to use weighted averages that are less than all years

in their chain-ladder and related methods. Similarly, both the ODP bootstrap and the

GLM bootstrap can be adjusted to only consider the data in the most recent diagonals.

For the GLM framework (and the GLM bootstrap model), we can use only the most

recent L + 1 diagonals (since an L-year average uses L + 1 diagonals) to parameterize

the model. e shape of the data to be modeled essentially becomes a trapezoid instead

of a triangle, the excluded diagonals are given zero weight in the model and we have

fewer calendar year trend parameters if we are using formula (3.29). When running

the GLM bootstrap simulations we will only need to sample residuals for the trapezoid

that was used to parameterize the model as that is all that will be needed to estimate

parameters for each iteration.

For the ODP bootstrap model, we can calculate L-year average factors instead of

all-year factors and only have residuals for the most recent L + 1 diagonals. However,

when running the ODP bootstrap simulations we would still need to create a whole

resampled triangle so that we can calculate cumulative values.

34

But, for consistency,

we would want to use L-year average factors for projecting the future expected values

from these resampled triangles.

e calculations for the GLM bootstrap are illustrated in the companion “GLM

Bootstrap 6 with 3yr avg.xlsm” le. Note that because the GLM bootstrap estimates

parameters for the incremental data, the tted values will no longer match the tted

values from the ODP bootstrap using volume-weighted average development factors.

34

e tted values for the “unused” diagonals would be calculated using the L-year average ratios, but the

corresponding residuals for those diagonals are all excluded from the sampling process.

24 Casualty Actuarial Society

Using the ODP Bootstrap Model: A Practitioner’s Guide

Depending on the data, the tted values from the simplied GLM (ODP bootstrap) may

or may not be a reasonable approximation to the GLM framework (GLM bootstrap).

Note that this discussion of using L-year average factors assumes volume weighted

averages to be consistent with the GLM framework. is also assumes that all of the

diagnostic tests will be adjusted to reect the use of the last L + 1 diagonals, although

this is beyond the scope of the monograph. Finally, other types of averages could be

used (i.e., straight average, average excluding high & low, etc.) to be more consistent

with what actuaries might use in a deterministic analysis, but these typically move

further away from the GLM framework and are beyond the scope of this monograph.

4.4. Missing Values

Sometimes the loss triangle will have missing values. For example, values may be

missing from the middle of the triangle, or a triangle may be missing the oldest diago-

nals, if loss data was not kept in the early years of the book of business.

If values are missing, then the following calculations will be aected:

• Loss development factors

• Fitted triangle—if the missing value lies on the most recent diagonal

• Residuals

• Degrees of freedom

ere are several solutions. e missing value may be estimated using the surrounding

values. Or, the loss development factors can be modied to exclude the missing values,

and there will not be a corresponding residual for those missing values. Subsequently,

when triangles are resampled, the simulated incremental corresponding to the

missing value should still be resampled so that the cumulative values in those rows can

be calculated, but they would still be excluded from the projection process (i.e., not

included with the sample age-to-age factors) to reproduce the uncertainty in the original

dataset.

If the missing value lies on the most recent diagonal, the tted triangle cannot

be calculated in the usual way. A solution is to estimate the value, or use the value in